Market

April 29, 2024

LME aluminum price struggles to hold onto recent gains, quarterly results and more

Written by Guillaume Osouf

The LME 3-month price is moving down on the morning of April 29 and was last seen trading at $2,559/mt.

Last week, after falling from its recent peak, the price found support at $2,560/mt. There was a breach of the level earlier this morning. However, the price has rebounded and is seen trading at $2,560/mt at the time of writing.

SHFE prices were broadly stable on April 29. The cash contract settled at RMB20,610/mt and last traded at RMB20,515/mt.

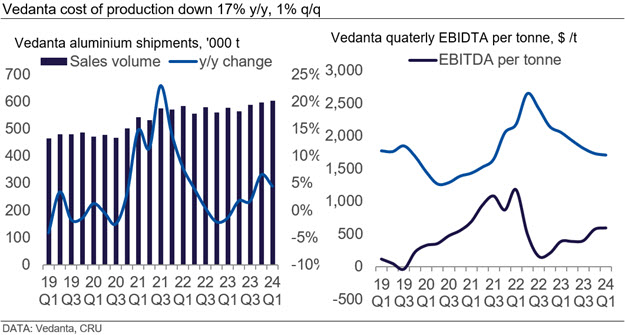

Vedanta highlights cost improvement at its latest quarterly results

On Friday, Vedanta released its latest quarterly results for its FY 2024, ending March 31. The company’s consolidated EBITDA of ₹8,969 crore was down 4% y/y, with an EBITDA margin of 30% versus 29% last year amid net sales of ₹34,937 crore, down 6% y/y.

For aluminum, Vedanta achieved its highest ever annual aluminum cast metal production at 2.37 mt during the entire fiscal year, up 3% y/y; and alumina production at its Lanjigarh refinery increased 1% y/y to 1.813 mt.

The company also stressed a cost reduction that reached $1,711/mt in Q1, down around $940/mt in the last seven quarters, allowing the producer to stand in the first quartile of the global cost curve. Finally, the commissioned Train-I at the Lanjigarh refinery will take the total capacity to 3.5 mt/y Vedanta reported.

Arun Misra, executive director of Vedanta, declared: “FY 2023-24 has been a remarkable year for Vedanta. We have achieved record production across our key businesses, a testament to our consistent focus on operational excellence. This focus, coupled with our commitment to cost leadership, ensured strong margins even during a challenging commodity market. We’re especially proud of the Lanjigarh refinery expansion to 3.5 MTPA, taking us closer to a fully integrated 3 MTPA aluminum operation.”

He added, “Our commitment to sustainability has been recognized globally – we topped the ESG rankings in India and ranked third worldwide. This focus is further strengthened by securing 1,826 MW of renewable power through PDAs, with the first power delivery scheduled for Q1FY25.”

Kaiser shows optimism about demand outlook

After a faster-than-expected start to 2024 in some end markets, U.S. aluminum products manufacturer Kaiser says it anticipates demand will improve throughout 2024.

But the Tennessee-based company cautioned: “In aerospace/high-strength applications, a more cautious outlook is warranted on expected build rates for domestic large commercial jet production in the near-term resulting in anticipated flat conversion revenue in 2024 following a strong 2023. The long-term demand outlook for these platforms remains unchanged. The company believes demand for other aerospace/high-strength applications remains strong.”

As for the other segments it was added: “Now that destocking is complete, the company expects the rest of its end markets to perform consistently.”

It also stated: “Kaiser remains well positioned in the current demand environment as a key supplier in diverse end markets with multi-year contracts with strategic partners.”

Franklin-headquartered Kaiser’s comments came with the release of its Q1 results, which showed drops in most key performance indicators – shipments down 2.7% y/y to 291 Mlbs (132,000mt); sales revenue down 8.7% to $738 M y/y; and an average realized price of $2.53/lb versus $2.70/lb last year. However, net profit rose 54.7% to $24.6 M mainly thanks to much lower production costs of $643 M against a year-ago level of $731 M.

Kaiser’s president and CEO Keith Harvey said: “The year is off to a good start with our first quarter results surpassing our internal expectations on more normalized business conditions with improved operating efficiencies across all platforms. Both the general engineering and automotive end markets are off to a faster start than expected at the beginning of the year while aerospace/high-strength, which was strong year-over-year, was softer than our original expectations.”

He added: “We remain committed to controlling costs, including the successful execution of our revised metal sourcing strategy, and improving overall operating efficiencies to drive profitable growth.”

Latest AA shipment report for extrusions shows persistently weak demand

The U.S. Aluminum Association released its latest shipment report for extruded products. According to the report, shipments in March 2024 totaled 383.2 M pounds, representing a drop of 10.6% y/y and up 4.5% m/m. For the YTD period until March, total shipments are now at 1.12 bn pounds, which is down 8.6% y/y.

It has now been two years since the sector has been in contraction mode, and this is the first double-digit decline since November 2023. The report follows the one for sheet and plate released two weeks ago. Shipments for FRP did show a growth y/y but it was limited to 1.7% versus a growth of 12.9% y/y in February. A similar trend was seen with the index of new orders report for March, which showed a growth of 0.2% y/y only compared to the growth of 9.3% y/y reported in February.

Ball reports lower shipments in North America, offset by growth in other regions

Last Friday, Ball Corporation released its latest results for 2024 Q1.

Operating earnings for beverage packaging in North and Central America were $192 M in Q1 on sales of $1.40 bn, compared to $183 M on sales of $1.50 bn during the same period in 2023. For the EMEA region which includes Europe, operating earnings were $85 M in Q1 on sales of $810 M; compared to $73 M on sales of $834 M during the same period in 2023. Finally, in South America, operating earnings for Q1 were $55 M on sales of $482 M compared to $50 M on sales of $450 M during the same period in 2023.

Global beverage can shipments increased 3.7% y/y in Q1. In North America, shipments were down 2.4% y/y, which were offset by a growth of 1.1% y/y in the EMEA region and a growth of 26.3% y/y in South America.

Daniel W. Fisher, chairman and CEO said: “We delivered strong first quarter results. Following the successful sale of the aerospace business in mid-February, we have executed on our plans to immediately deleverage, initiate a large multi-year share repurchase program and position the company to enable our purpose of advancing the greater use of sustainable aluminum packaging. We continue to complement our purpose by driving innovation and sustainability on a global scale, unlocking additional manufacturing efficiencies and activating an operating model to enable high-quality, long-term shareholder value creation.”