Market

May 21, 2024

LME prices surge as Rio Tinto declares force majeure on alumina

Written by Guillaume Osouf

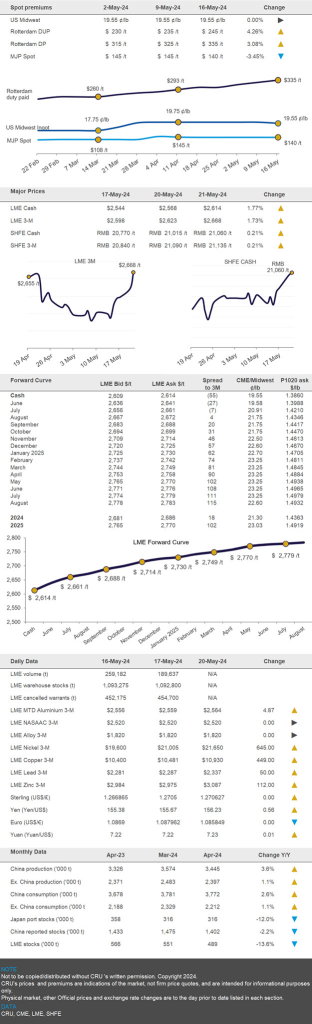

The LME 3-month price is moving higher again on Tuesday, May 21 and was last seen trading at $2,668/mt.

The U.S. dollar has been under pressure since last week as investors are now betting that falling inflation in the U.S., as indicated by the latest CPI data, will give the Fed more room to cut interest rates.

Meanwhile, SHFE cash continued to trade firmly above RMB21,000/t. The cash contract settled at RMB21,060/t and last traded at RMB21,040/t.

Rio Tinto declares force majeure on Australian alumina shipments

A gas shortage has forced Rio Tinto to issue a force majeure on third-party alumina shipments from operations in Queensland.

Supplies of the fuel to the company’s alumina refineries in Gladstone have been restricted since March due to problems with the Queensland Gas Pipeline. It is likely to take significantly longer than previously expected for supplies to again be at capacity, Rio Tinto said.

“The pipeline operator’s current estimate is for a return to normal levels in the second half of 2024. Until then, Yarwun and QAL [Queensland Alumina Limited] will continue to operate at lower capacities,” a company spokesperson was quoted as saying in media reports.

However, Rio Tinto anticipates its aluminum smelters (which source alumina from other producers as well as the company’s own operations) will be able to maintain production until gas supplies return to normal. The disruption began in early March when a fire broke out at the gas line. Rio Tinto said at the time it was monitoring the situation and working with pipeline operator Jemena.

IAI update: IAI numbers indicate 3.6% y/y growth in global output in April

The International Aluminum Association (IAI) this week released primary production data for April 2024.

Total worldwide production on an annualized basis came in at 72.0/mt – up 0.1% m/m from the revised March number of 71.9/mt and up 3.6% y/y. Production in World excluding China in April was reported at 29.3 mt, down 0.1% from March.

The IAI also made minor revisions to their previous production estimates. Output in China was revised up for January, February, and March by 20/kt, 16/kt and 18/kt, respectively. Output in the GCC was also revised up marginally by 1/kt and 2/kt for January and February. Production for this region was revised down by 1/kt for March. African production was up by 1 kt for January.

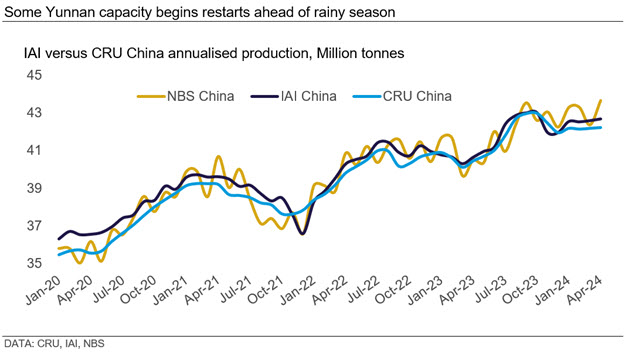

For Chinese production, the IAI estimated the annualized March output at 42.7/mt – up from the revised March number of 42.6/mt and up 5.0% y/y. Smelters in Yunnan began restarts ahead of the rainy season in April due to better power availability for the industry.

We understand there were three main reasons for this:

– Less power than expected has been required for industrial purposes in Guangdong Province, to which Yunnan is a key provider due to weaker manufacturing demand.

– Demand for power from other industries in Yunnan Province itself has decreased.

– The expansion of renewable power in Yunnan Province.

CRU’s annualized production number for April is below the estimate reported by the IAI, at 42.2 mt/y and follows the fluctuating trend by the NBS numbers.

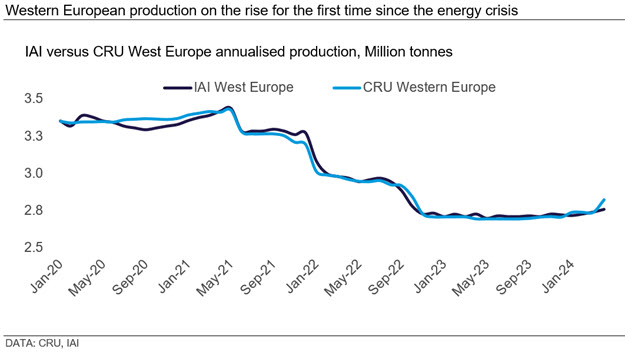

The IAI reported annualized production of 29.3/mt outside of China in April, down 0.1% on March. Looking at the m/m differences, production increased in Western Europe (0.7%) and declined in Asia excluding China (1.0%). Production in other regions only saw minor changes.

The region we will focus our attention on is Western Europe where significant capacity has remained offline due to the spike in energy prices in recent years. Following significant declines in energy prices and the current high price environment, a restart began at Trimet’s St. Jean smelter in France in 2024 Q1. It should be noted, however, that energy prices do remain elevated above pre-crisis levels. We expect further idle capacity in Germany to restart and continue throughout the year.

Alcoa announces update on acquisition of Alumina Limited

Alcoa yesterday announced it has entered into a “Deed of Amendment and Restatement” in relation to its acquisition of Alumina Limited.

The amendment is the result of cooperative discussions with all parties – including CITIC Group, which holds or controls through its affiliates an 18.9% stake in Alumina Limited – to advance the transaction, which is expected to be completed in the third quarter. Alcoa has a longstanding working relationship with CITIC, which holds a stake in the Portland Aluminum joint venture in the state of Victoria, Australia, alongside Alcoa of Australia.

Alcoa and Alumina have amended their agreement so that a CITIC affiliate will receive about 1.5% of Alcoa’s outstanding common stock, instead of New Alcoa CDIs.

“The agreed change to the Scheme brings us a step closer to completing the transaction, which will provide significant and long-term benefits to both Alcoa and Alumina Limited shareholders,” said William F. Oplinger, President and CEO of Alcoa.

The full statement can be found on Alcoa’s website.

Protestors hold up aluminum waste relocation in Thailand

Villagers have halted the transfer of 7,000 t of aluminum dross from Win Process Company’s recycling plant at Rayong by refusing to allow the cargo to be unloaded at a Metalcom recycling and aluminum plant in Chon Buri, Thailand. A 108-tonne consignment of the aluminum smelting by-product was earlier moved without incident between the two sites.

A fire and explosions at Win Process’s industrial waste warehouse on April 22 have caused Chon Buri residents to worry about the operation’s level of safety. Dangerous chemicals were found at Rayong and nearby residents relocated, local media reported. Talks are taking place between Chon Buri’s governor and representatives of the protestors. Authorities have charged Win Process with damage to property and human life by recklessness or negligence.