Market

July 16, 2024

CRU: European scrap prices weaken in July

Written by Guillaume Osouf

So far in 2024, European scrap prices have been increasing steadily month by month, which contrasts with the volatility seen on the LME price. There were several reasons for this: the conservative approach to 2024 that saw many scrap buyers buying less than what they needed, the fact that less scrap returned to the market as semi-finished producers were running below full capacity, and the growing number of recycling projects that maintain a strong demand for scrap.

Currently, for the first time this year, we see lower prices this month across all grades with some regional disparities. The summer season with widespread maintenance closures expected in August is, of course, a factor. To this we can add more subdued demand with packaging consumption now past its peak and fresh weakness in automotive-related demand. Furthermore, the flooding in Switzerland impacting two large plants operated by Constellium and Novelis is expected to release more scrap to the market. We maintain a view that it won’t be long before European scrap prices start increasing again, possibly as early as September when annual contract negotiations resume.

DIN 226 price down but not out

Secondary ingot price remains at historically high levels

The DIN 226 price came under more pressure this month with the latest assessment at €2,415/t, down a marginal €20/t from the previous assessment. Nevertheless, the secondary ingot price remains at a high level historically. Indeed, if we exclude last month, one needs to go back to September 2022 to see the DIN 226 price trading above €2,400/t. In the meantime, the LME price has been broadly unchanged since the last report, and so is the Rotterdam ingot premium. As a result, the differential between DIN 226 and the primary price (LME + ingot premium) has held relatively steady as seen in the accompanying chart.

Margins improve for secondary producers amid lower scrap prices

This month the DIN 226 price declined, but so did the underlying secondary scrap prices. Clean old aluminum alloy sheet (taint/tabor) was last assessed at €1,875/t, down €25/t from last month. The price for mixed castings (tense) was down a steeper €50/t to €1,850/t and mixed aluminum turnings (telic) was last priced at €1,600/t, also down €50/t m/m.

In the previous report we highlighted the stronger increase in the prices for secondary scrap grades in comparison to the DIN 226 price, which we heard put many secondary producers in an uncomfortable position. This time both the DIN 226 price and secondary scrap prices are down m/m, but scrap prices dropped faster, meaning the margins for producers have improved to some extent. We wouldn’t expect that trend to continue, though, as tightness in this market remains and there is no doubt secondary scrap prices will resume their upward trajectory as soon as demand comes back after the summer.

Post-production grades feel the pressure as well

For the first time since October 2023 all post-production scrap prices that we assess are down m/m. Among the specialty mill scrap, the price for 3xxx series and 5xxx series are both down one percentage point, last at 97% and 100% of the LME price, respectively. For packaging scrap, we have Class I and Class II at 93% and 92%, respectively, also down one percentage point m/m. Class III and UBCs are stable though last priced at 82% and 70% of the LME price, respectively.

It is worth noting that we do see some disparity across different regions. The place where scrap prices have dropped the most seems to be Italy, and at the other end of the spectrum, scrap prices in Greece are holding well. Indeed, UBC prices were indicated to us as low as 68% in Italy and as high as 76% in Greece. Besides local market dynamics, one needs to bear in mind the difference in freight costs, which can make a huge difference in final prices across different regions.

The last category of scrap we assess, extrusions scrap, also saw its price declining m/m now at 106% of the LME price. This is two percentage points down from the prior report. Here also we hear of great disparities, with the price ranging from 105% to 109% depending on the logistic costs. Given our assessment is for locations around central Europe, the logistic cost will be much less than for countries like Greece or Spain and therefore our prices will be lower as a result.

The summer lull is a key factor but not the only one…

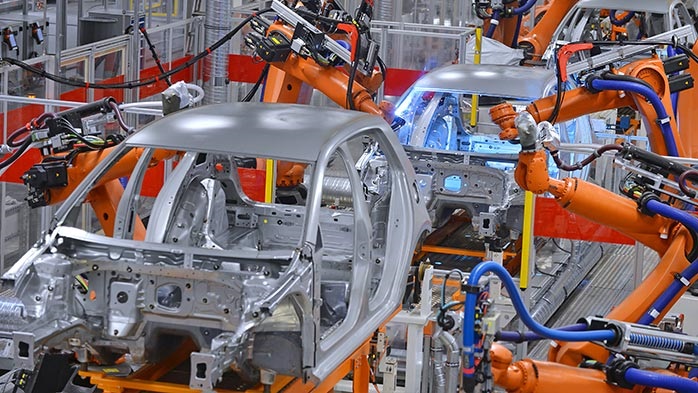

Weaker auto demand triggers longer maintenance closures

The summer season is, of course, a key factor behind the lower scrap prices m/m. We do hear, though, of extended maintenance closures with some of our contacts closing for the whole month of August. The overall feedback is that closures are more or less in line with previous years. However, when longer maintenance closures are scheduled, this would be due to a weaker demand. So far the only end-market affected by longer maintenance closures that we heard of is automotive and Italy seems to most affected. As for the packaging sector, demand has peaked as well, which makes more sense given we are approaching the middle of the summer and the cans needed have already been produced. The price for UBC therefore is likely to drop slightly in the coming months as old cans make their way back to collection points.

Tightness could ease from the recent closures

One important headline since the last report has been the closures of two large plants in Switzerland operated by Novelis and Constellium due to flooding. The site is an important manufacturing complex employing 1,200 employees across the two companies.

According to our estimates, the Novelis site has a capacity of around 130,000 t/y of aluminum semi-finished products, while the Constellium plant operates around 75,000 t/y.

Both manufacture flat rolled products for the automotive and aerospace markets. As for the scrap supplied, we believe most of the deliveries are in closed loop, meaning the interruption of those plants should release some material to the open market. While this is unlikely to balance the market given many months of tightness, this should ease some of the supply. This is unlikely, though, to have an immediate impact on prices, but it will possibly prevent them from increasing more in the short-term assuming demand does not change.

In conclusion, one month into the summer, European scrap prices have not only stabilized, but they are down m/m for the first time this year. The lack of spot activity ahead of the maintenance closures in August are, of course, a key reason, but demand is also seen weakening in key sectors such as in automotive and packaging demand has passed its peak. We could expect prices to decline further or at least remain steady next month due to the lack of drivers. However, our view for European scrap prices remain reasonably bullish for the rest of the year as tightness should quickly return when demand makes a comeback in September. The recent incidents in Switzerland could ease some of that tightness, but nothing that can fully satisfy the potential for higher scrap demand later this year.