Market

August 26, 2024

CRU- Aluminum market updates

Written by Guillaume Osouf

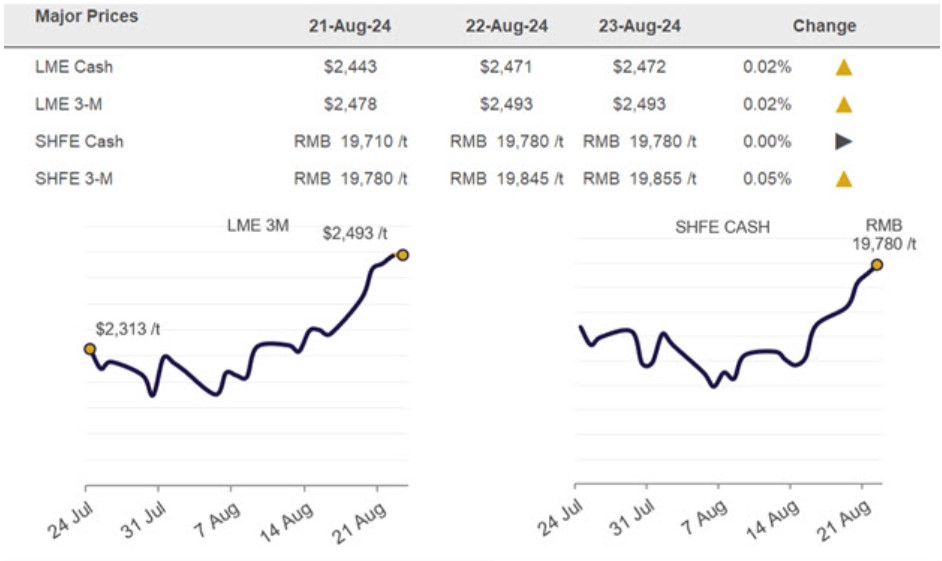

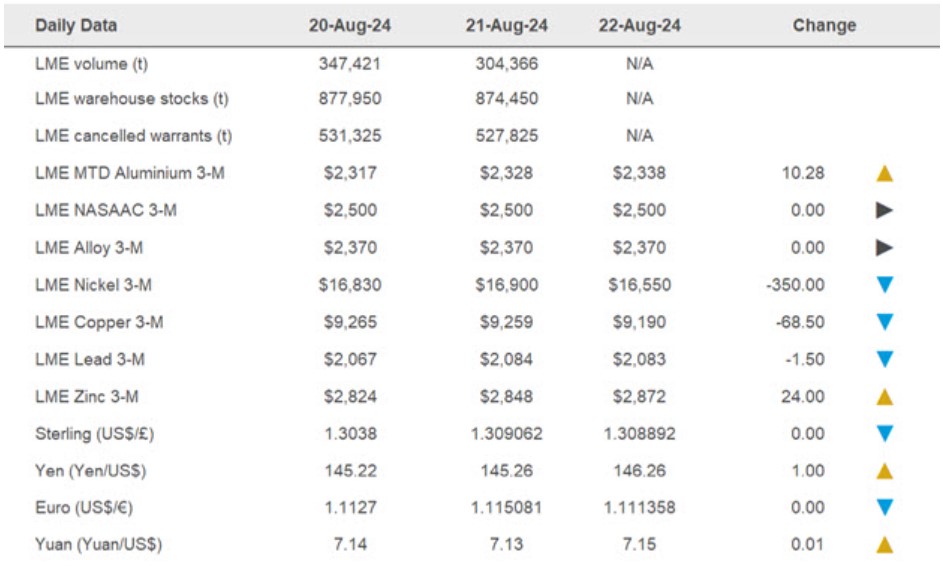

As the LME is closed today for holiday, we reflect back on Friday, August 23rd as the LME 3-month price was trading around $2,497/mt.

After recovering over 10% in August since the price bottomed out at the end of July, resistance has finally hit at $2,500/mt this week. The price is expected to consolidate its recent gains in the coming sessions.

Meanwhile, the SHFE cash price was also broadly unchanged on Friday. The cash contract first settled at RMB19,780/mt and last traded at RMB19,755/mt.

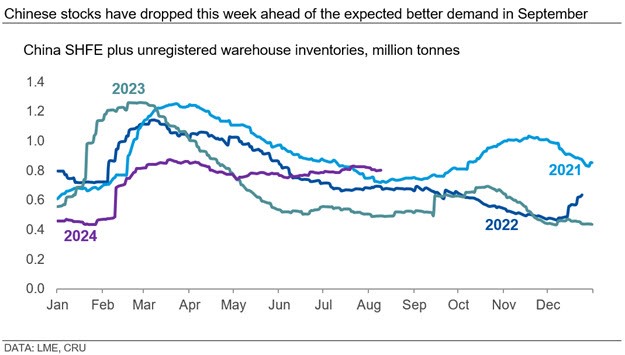

Chinese stocks down as demand outlook improves, LME stocks also down slightly

The level of Chinese reported stocks declined noticeably this week, down 16,900 mt since last Friday and last at 802,200 mt. Among this, Henan stocks declined mainly due to improving orders from fabricators in the province. Moreover, Jiangsu stocks declined due to less inflow during the summer period.

In contrast, Guangdong stocks increased slightly due to more inflows from smelters in the southeast region, given margins have improved following the higher SHFE price. Meanwhile, we hear smelters have been keen to send more ingots into warehouses before downstream demand improves in September.

Meanwhile, LME stocks were last reported at 870,950 mt, down 14,425 mt since last Friday. There have not been any significant developments in LME stocks in August, with the level of cancelled warrants gradually declining as the metal leaves the warehousing system.

Cancelled warrants were last at 524,325 mt, down 43,135 mt since the start of August, with the level of open warrants now standing at 346,625 mt.

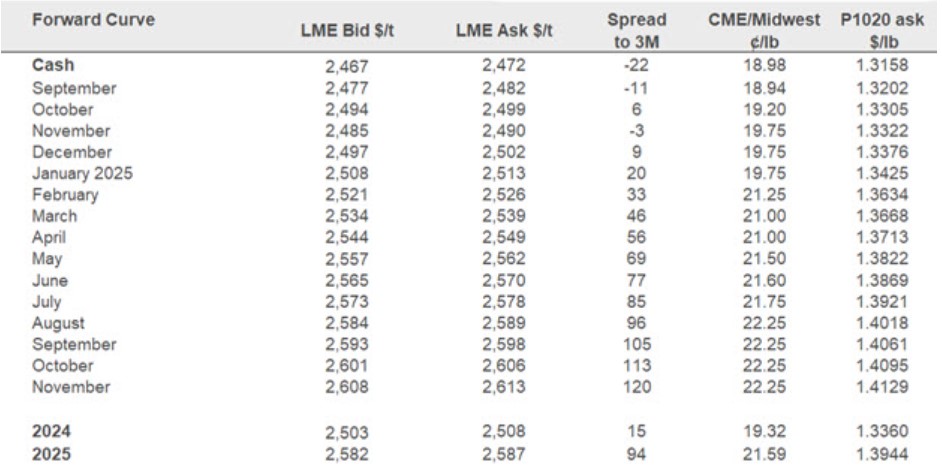

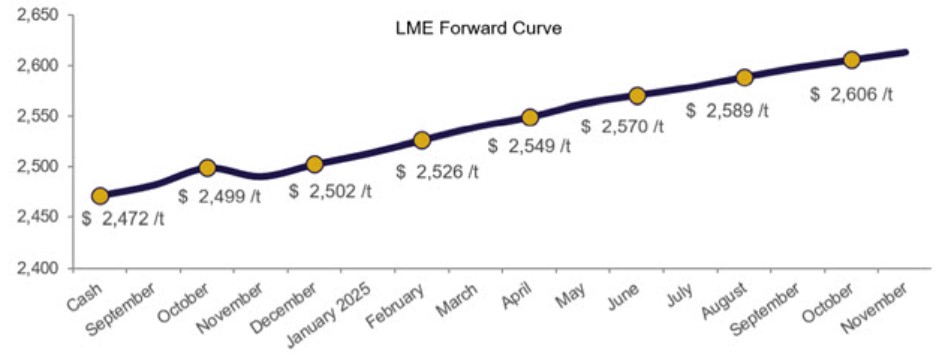

One thing to follow is the tighter spreads. The October-November LME spread was last seen trading at $10/mt backwardation. If this level was to increase it could prompt some previously canceled metal to be redelivered into the exchange.

Rio Tinto and Teck acting to counter Canadian rail strike

Miners Rio Tinto and Teck Resources are taking a series of measures to mitigate the impact of Canada’s two largest railway companies shutting down their networks during a labor dispute. Rio Tinto says it will truck some materials and products, and increase the use of its own rail network, primarily 400 km serving its iron ore operations in Quebec, as well as Newfoundland and Labrador, and around 100 km for its aluminum business.

Teck stated it is looking to use alternative transportation, with a spokesperson for the Vancouver-based base metal miner adding that interruption of rail services is negative for its partners and customers in the critical minerals supply chain.

Normal rail services in the vast country were suspended on August 22 after operators Canadian National Railway and Canadian Pacific Kansas City locked out more than 9,000 unionized workers. The Mining Association of Canada said it is seriously concerned about the damage the development may cause.

“As the single largest industrial customer group of Canada’s railways, the mining sector has seen first-hand how detrimental unpredictable work stoppages are to Canada’s reputation as a reliable trading partner,” said association president and CEO Pierre Gratton before adding, “The urgent need for Canadian minerals and metals presents a generational opportunity, and we are in a race with our competitors to meet global demand. A first-ever, simultaneous halt in [the] … rail service could not come at a worse time.”

The association said rail freight volume in 2022 was 283.6 million mt, of which 132 million mt was crude minerals and 28.3 million mt processed mineral products, together accounting for 56% of the total.

Hindalco to invest $10 billion in major expansions plans across India and the US

Hindalco Industries is set to undertake a significant expansion with investments totaling $10 billion, said Chairman Kumar Mangalam Birla at the company’s annual general meeting held on August 22. Mr. Birla outlined plans for ongoing and near-term projects, including expansions in aluminum and copper smelters, the Aditya flat rolled product plant, a new alumina refinery in Rayagada, and the Bay Minnette expansion in Novelis.

Hindalco is considering a brownfield expansion of approximately 200,000 mt per year at its aluminum smelter in Odisha, with a significant portion of the power requirements to be met through renewable energy sources, Birla said in his speech. In addition to its aluminum initiatives, the company is planning to expand its copper smelting capacity and is exploring the establishment of a brownfield facility in Gujarat to address the rising demand for this metal in India.

Finally, Mr. Birla stressed the strategic investment in Novelis and its rolling and recycling project in Bay Minette, which is well set to become one of the most advanced and automated plants in the industry.

Comstock expands into aluminum recycling

Specialized U.S. recycler, Comstock Metals, has announced its first shipments of aluminum recovered from solar panels. “This initial sale exceeded our expectation of secondary recovery, achieving more than fifty cents per pound for these aluminum scrap grades,” the Nevada-based company said.

The new revenue stream follows on from Comstock’s work developing technology to enable efficient recycling of end-of-life solar panels into reusable copper, silver, glass and other materials, as well as aluminum. The aim is to create a 100% closed-loop, zero-landfill process. The maiden shipments of recycled aluminum totaled more than 3,000 lbs (1,360 kg). The company expects aluminum recovery to be 10% to 15% of a solar panel’s weight.

Comstock Metals operates a commercial, demonstration facility in Silver Springs, Nevada, and is in the process of obtaining permits for a large-scale expansion to serve the expanding solar power industry in the western U.S. “We are now engaged with both large-scale suppliers for high-volume, longer-term, revenue-generating supply commitments as well as large-scale, off-take customers and partners for quality material sales,” said company president Fortunato Villamagna.

Much of the Comstock group’s decarbonization work to-date has been on converting underutilized woody biomass into net-zero renewable fuels as well as end-of-life metal extraction projects.