Market

September 3, 2024

Can copper smelters survive shrinking margins?

Written by James Birch & Leonardo Meza

The intensifying copper concentrate deficit has exerted significant downward pressure on treatment and refining charges (TC/RCs) – the fees paid by mining companies to smelters for processing copper concentrate into refined copper. As supply constraints tighten, smelters face increased competition for available concentrate, leading to a substantial decline in TC/RCs.

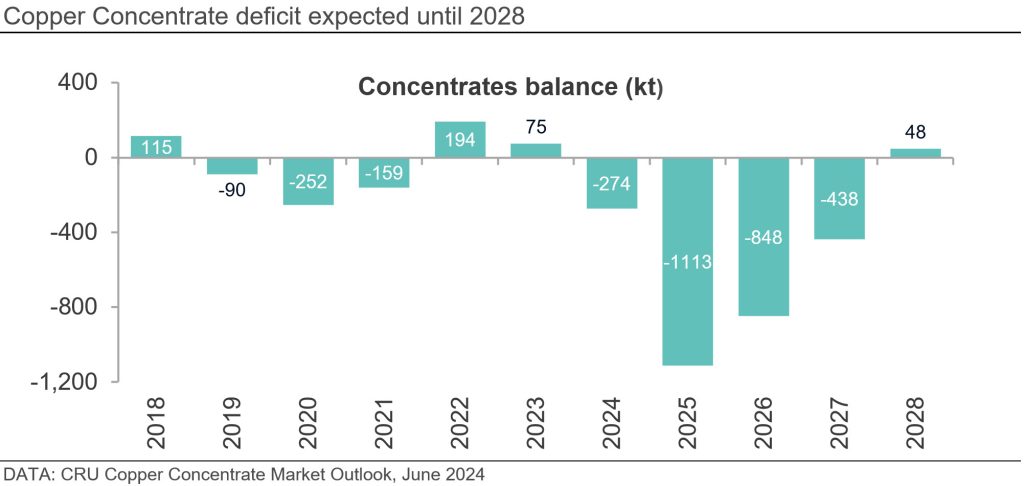

The market has experienced a dramatic shift from a projected surplus to a deficit of approximately 274 kt in 2024, increasing to 1,113 kt in 2025. This supply shortfall has triggered a sharp decline in TC/RCs on the spot market at the start of 2024. Since April 2024, the current spot for the TC has remained around -10$/ t, with some reports of positive TC/RCs so far in August, though the contract market has remained relatively quiet, with many smelters opting for extended maintenance.

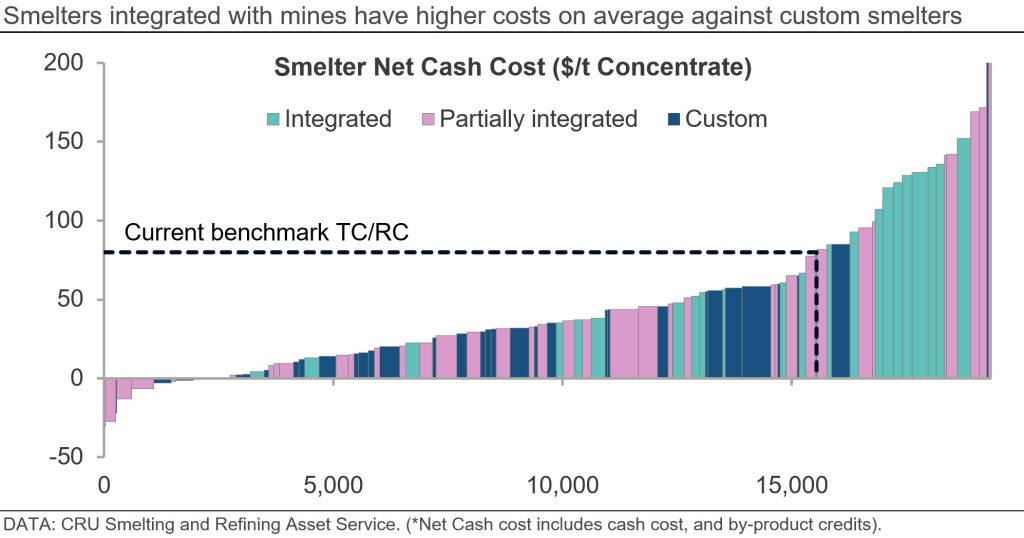

Currently, smelters are not too affected as many are presently on long-term concentrate contracts, which were set around a benchmark of 80 $/t concentrate at the end of 2023. However, as the concentrate deficit tightens, bargaining power will be with the mining companies and the new benchmark TC/RC for long-term contracts (due to be set in November 2024) could be driven to historical lows. The mid-year TC/RC agreed between Chinese companies and Antofagasta was agreed at only 23.25/2.325 TC/RC.

In response to the deficit, some smelters have considered reducing capacity or bringing forward maintenance schedules to alleviate the pressure on concentrate supply, which could temporarily help stabilize TC/RCs. Decreasing the smelting rate or even processing concentrate at a lower-than-benchmark TC is still preferable to completely shutting down an asset, as the costs of heating the furnace, converters, as well as setting up the auxiliary plants (such as the acid and oxygen plants) greatly outweigh the cost of operating at a loss.

Custom vs integrated: Who will lose out?

When TC/RCs are very low, we would expect smelters that are high cost to be the main losers in this situation. However, many of the smelters that are higher net cash cost are integrated with mines, meaning they do not have supply issues. Many of the smelters that will be affected by the tight concentrate market will be the custom smelters who are more dependent on signing long-term contracts and buying from the spot market. Currently about 63% of the smelter market is custom, with a mix of partially integrated and fully custom assets.

Custom smelters are mainly concentrated in East Asia, specifically China, South Korea and Japan. Access to copper in this region has traditionally been limited and all three countries are very dependent on imports of concentrate. This year, China is estimated to produce 42.1% of the world’s copper anode/blister from its smelters, while Japan will produce 8.3%; and South Korea only 3.3%. However, this is all from the world’s largest smelter Onsan, with a capacity to process 2,200 kt of concentrate, making it one of the world’s most important smelters.

While these assets are some of the most advanced and efficient smelters in the world, their dependency on concentrates imports leaves them vulnerable to a low TCRC market, meaning they face operating at lower margins or at a loss, potentially cutting production. CRU currently does not expect any smelters to fully close due to the high cost involved, however, smelters may use the time to do required long term maintenance during a low profit period. There is also the possibility that many of the assets will be subsidised by governments in these countries as access to copper is very important to their industries and economies.

To offset low TCRCs, smelters will look to higher free metal revenue from current high copper, gold and silver prices. This will mean smelters will push for as high recoveries as possible as all metal loses come out of the free metal agreed with the mine. However, concentrates with higher grade precious metals will be the most sought after, meaning that mines can drive down TC/RCs on this concentrate even further, or potentially increase the payable rates for such concentrate.

Increases in smelter capacity still planned

The ongoing pressure on custom smelters will also increase further into the future as new integrated smelters are planned to open in Indonesia and Africa. In 2024, Kamoa Smelter in the DRC, Freeport’s new Manyar Smelter and Amman’s new Sumbawa smelter in Indonesia will cumulatively add 1,200 kt of smelter capacity, all of which is integrated and supplied.

However, extra smelter capacity does not stop with the previously mentioned projects. The Hayden smelter will likely resume operations in 2025, and the Palabora smelter may even restart later this year, adding another 190 kt and 140 kt of copper per year, respectively. Most importantly, Indonesian export licenses for concentrate are set to end in December 2024 as the new Freeport and Amman smelters come online.

This puts even more pressure on custom smelters looking to secure feed in 2025. In the face of such challenges, smelters may choose to increase their use of secondary materials, whether scrap or blister, to mitigate their losses. An alternative lies with potential increases in by-product prices – sulfuric acid and other sulfur products – which could tilt the scales in the smelters’ favor if the sulfuric acid market is robust in 2025.

With increased smelter capacity from integrated assets, expected copper concentrate scarcity up until 2028, and squeezed operating margins due to declining TC/RCs, 2025 will undoubtedly be a challenging year for stand-alone smelters. However, this challenge should subside in the following years as concentrate becomes more readily available.

This article was first published by CRU. To learn more about CRU’s services, visit www.crugroup.com.