Market

September 16, 2024

The China tariff revisions and their implications

Written by Lewis Leibowitz

Last Friday, September 13, the Office of the U.S. Trade Representative announced final revisions to the China tariff structure under a statutory four-year review provision. The four-year period expired in July, 2022. But the government took extra time to evaluate thousands of public comments.

For a few products, such as certain production machinery that the U.S. wants to import to improve domestic manufacturing capacity and certain medical equipment, such as syringes, medical gloves and masks, the imposition of additional tariffs could negatively affect supply chains. But the Section 301 exclusion process, which has been dormant for several years, was only offered to certain products, such as specific machinery, medical equipment and industrial robots.

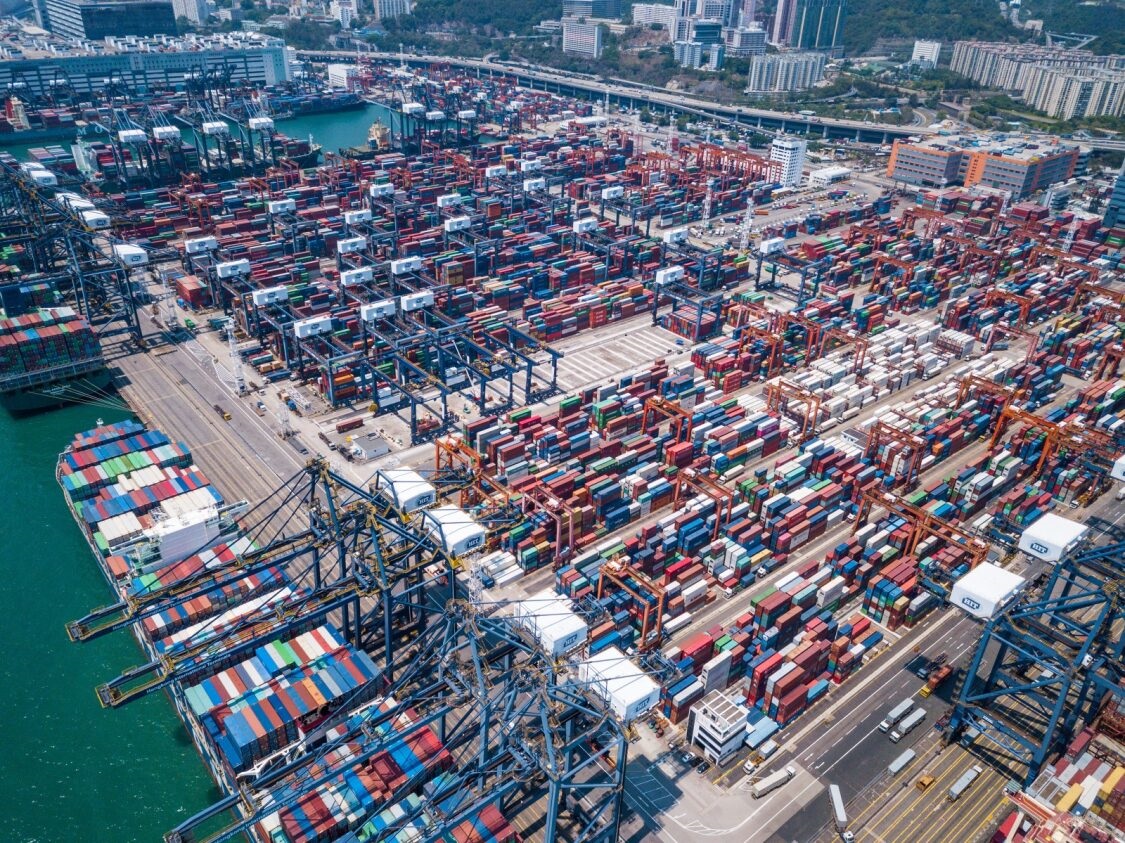

The specifics of the final rules are so detailed that an op-ed piece could not possibly describe them all. Certain groups and companies, and those speaking for ordinary consumers, were disappointed in the final rules. Companies reliant on international trade supply chains predicted disruptions from the tariff increases, including a 100% levy on Chinese electric vehicles, which takes effect on September 27, 2024. However, cars on the water headed for this country are few and far between. Steel and aluminum products previously subject to Section 301 duties of a relatively low 7.5% will be subject to 25% duties, also effective September 27. But those Chinese-origin products are largely subject to massive antidumping and countervailing duties, so the increased tariffs won’t apply to much.

Other products will have delayed imposition of higher tariffs, usually to allow U.S. customers to develop alternative sources, either in the U.S. or in countries other than China. By 2026, tariffs on these products are scheduled to go into effect.

There were predictable criticisms (and rounds of applause) from the expected interest groups. The critics generally were from industry groups that have grown used to the massive increases in trade, most of which involve imports into the United States and not exports to China. Supply chain disruptions are a natural consequence of protectionism. It is noteworthy that many of the administration’s tariff increases taking effect in only two weeks involve products that are already not imported in significant volumes, due to trade remedy proceedings or other sanctions.

These groups have directed their most valid criticisms at the ineffectiveness of the tariffs to change China’s behavior. If tariffs have not had an appreciable effect on Chinese government policies, it is hardly reasonable to suppose the higher tariffs on a few goods will be enough to move the needle. That is a fair criticism; but it must be said that removing the tariffs would very likely be ineffective too.

We will not force China to abandon Communism or a command economy any time soon. Moreover, tariffs are not likely to protect American industries from foreign competition. America is part of the world and must share it with China and other countries—markets will continue to be global despite the wishes of many to deny it. And, absent open hostilities, the use of American market power will cause the Chinese economy to collapse. That strategy, famously employed during the Reagan administration, succeeded against the Soviet Union, an economy that Margaret Thatcher famously described as “Upper Volta with missiles.” We have to think differently about China, which is able to compete effectively with the United States in the area of military readiness.

So, what might work to change the behavior of China? I think a series of negotiations could have some effect. If negotiation would work, unilateral elimination of the Section 301 tariffs would not be a good first step. The rules announced last week step them up in some ways, but don’t remove much. So far, so good.

But any negotiation involves carrots as well as sticks. I would not generally define removal of damaging and controversial tariffs as a “carrot” for China. Their rhetoric confirms this.

We may do better by looking for areas where increased economic interaction could help China. One area that comes to mind is energy. China is now one of the largest energy importers in the world. China’s domestic production of energy is highly import-dependent. Three-fourths of that country’s oil use is imported, as is half of its natural gas. The United States is now a leading exporter of oil and gas. Agreeing to moderate the tariffs in some areas and offering to sell energy to China to displace Russia and Iran as its leading suppliers could be a useful approach. It would be very interesting to see China’s reaction.

An alternative approach could involve reducing the emphasis on military confrontation with China and fostering greater commercial and economic cooperation, along with balanced competition. The Western model, which prioritizes private initiative, may offer more advantages compared to China’s command and control system.

Wouldn’t it be wonderful to find out which is really best?

Editor’s note: The views, thoughts, and opinions expressed in the content above belong solely to the author and do not necessarily reflect the opinions and beliefs of Recycled Metals Update or its parent company, CRU Group.