Market

April 10, 2024

CRU: LME aluminum price breaks two-thirds of 2023 downward trend

The LME three-month price is moving up on the morning of April 10 and was last seen trading at $2,484/t.

Since the break of the 50% retracement of the major 2023 downtrend at $2,390/t just over a week ago, the LME price has faced resistance at the next 61.8% retracement at $2,455/t. Wednesday morning the price broke this level, which signifies the reversal of the previous downtrend and is a bullish signal for investors wishing to go long on LME aluminum.

Meanwhile, SHFE aluminum continued to make solid gains. The cash contract first settled at RMB20,310/t and last traded at RMB20,420/t, up another 1.5% d/d.

The longs rush back into aluminum as the price breaks key technical level

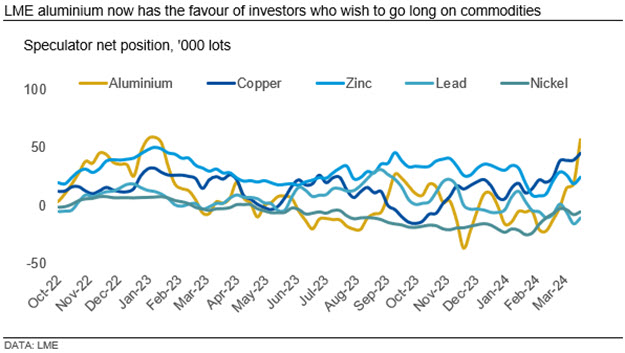

According to the latest Commitments of Traders Report published Tuesday and covering positions up to April 5, the net long position by investment funds increased significantly to 56,200 lots. The gross long position was last reported at 144,200 lots – the highest seen since mid-April 2022. Meanwhile, the gross short position dropped last week to 87,900 lots and is well below the recent peak of 130,000 lots reached at the start of March.

The move comes as the LME aluminum price keeps increasing, breaking key technical levels in the process. First there was the key 50% retracement level of the 2023 downtrend at $2,390/t. When the level was broken just over one week ago, the shorts were forced to cover some of their exposure while the majority of the longs were waiting for the next level to break.

On April 10, another major retracement level was broken, the 61.8% of that same downtrend at $2,455/t. This is expected to add even more long positions by investment funds as the break suggests that the downtrend which dominated prices last year is now fully reversed. This also means the new major trendline is the uptrend that started in August last year. The LME price is therefore more likely to follow this trend from now on, although consolidation is still expected to happen as soon as investors’ appetite reduces.

Turkey bans metal exports to Israel

Ankara will stop shipping 54 categories of products, including iron, steel and aluminum to Israel until there is a ceasefire in the Israel-Hamas War and Israel allows adequate aid into the territory.

“Israel continues to flagrantly violate international law and ignores the international community,” newswire services quoted Turkey’s trade ministry as saying.

Israel’s foreign minister Israel Katz responded by saying he had ordered the foreign ministry to prepare an extensive list of Turkish products that Israel would ban.

“[Israel] will not keep quiet about the unilateral violation of the trade agreements,” he added.

Ron Tomer, president of the Manufacturers’ Association of Israel, said about half of the country’s steel imports, as well as cement and marble, come from Turkey which, he claimed, is in the process of taking over other areas of Israel’s economy such as the construction sector.

“Maybe now the government will wake up and break away from Turkish dependence,” he added.

U.S. recycler Spectro Alloys announces expansion plans

U.S. aluminum recycler Spectro Alloys recently announced plans to expand its recycling capacities with a $71-million investment at its Rosemount campus in Minnesota. The company plans to recycle more end-of-life scrap aluminum to improve recycling rates in the region and meet a growing demand for recycled aluminum sheet ingot and extrusion billet.

Spectro Alloys will produce recycled billet and sheet ingot in a new 90,000-square-foot building along Highway 55. The first phase of the project will result in nearly 120 million pounds per year of additional recycling capacity and create up to 50 full-time jobs. The facility will include new equipment for sorting, melting, casting, sawing, homogenizing and packaging. Construction will continue through 2024. The facility is expected to begin production in mid-2025.

China’s automotive sector continues to perform well in March

In March, China’s auto dealers sold 2.694 million units of cars, more than the country’s vehicle output of 2.687 million units in the month, it was reported by the Chinese automotive association CAAM this week. Both volumes were higher by 78.4% and 70.2% month-on-month, respectively.

In the first three months of this year, the country’s total auto sales climbed by 10.6% y/y to 6.73 million units, and output rose 6.4% y/y to 6.606 million units. In terms of NEVs, the cumulative sales and output during January-March jumped by 31.8% y/y and 28.2% y/y to 2.09 million units and 2.115 million units, respectively.