Market

November 8, 2024

CRU: The scrap market remains tight, driven by high demand

Written by Marziyeh Horeh

In October, the scrap market stayed tight with familiar factors at play. China’s demand for imported scrap remains strong, often paying top dollar, while North America’s new recycling expansions continue to keep the market constrained. One big question is whether rolling mills might switch to primary aluminum if scrap prices keep climbing, making it less cost-effective to rely on scrap. However, environmental concerns and challenges with GHG emissions associated with primary aluminum could make this switch challenging.

In Mexico, ARZYZ Metals, an aluminum and non-ferrous metals company, announced a major $650 million expansion in Nuevo Leon. Governor Samuel García explained that this investment will add 80,000 tons of flat-rolled product (FRP) capacity, targeting automotive, HVAC, appliance, and construction industries. ARZYZ, traditionally focused on ingot and billet, is pivoting to meet rising local demand, fueled in part by Mexico’s recent 30% import duties on foreign products. This expansion could cover around 10% of Mexico’s domestic market.

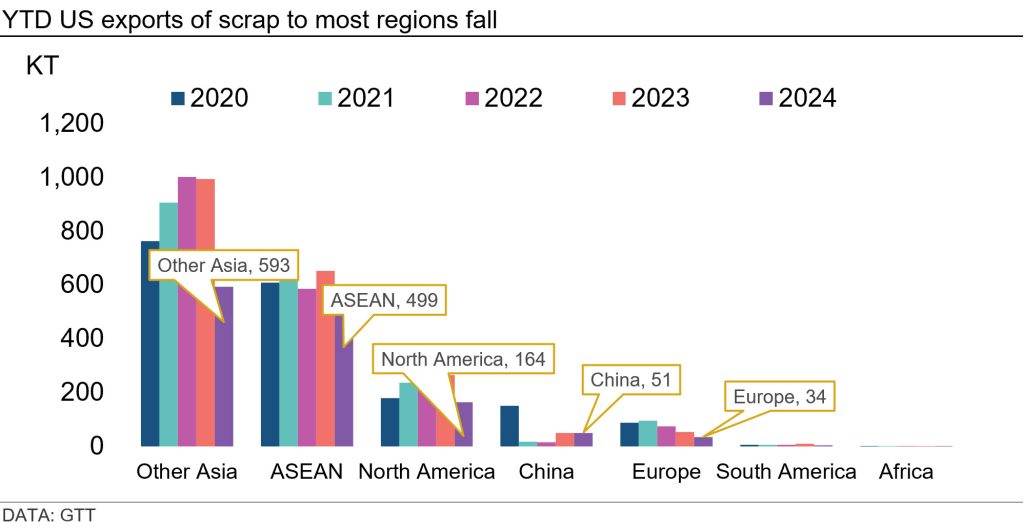

Recent data from Global Trade Tracker (GTT) shows that U.S. YTD scrap exports to most regions fell in October. As in previous years, the main destinations were Asian countries (excluding China), followed by North America and China. Y/Y exports to most regions dropped, while exports to China, albeit smaller, held steady. With China easing restrictions on waste imports, a possible impact could be an increase in the demand for scrap from the U.S. into China, thereby adding further pressure to the already tight North American scrap market.

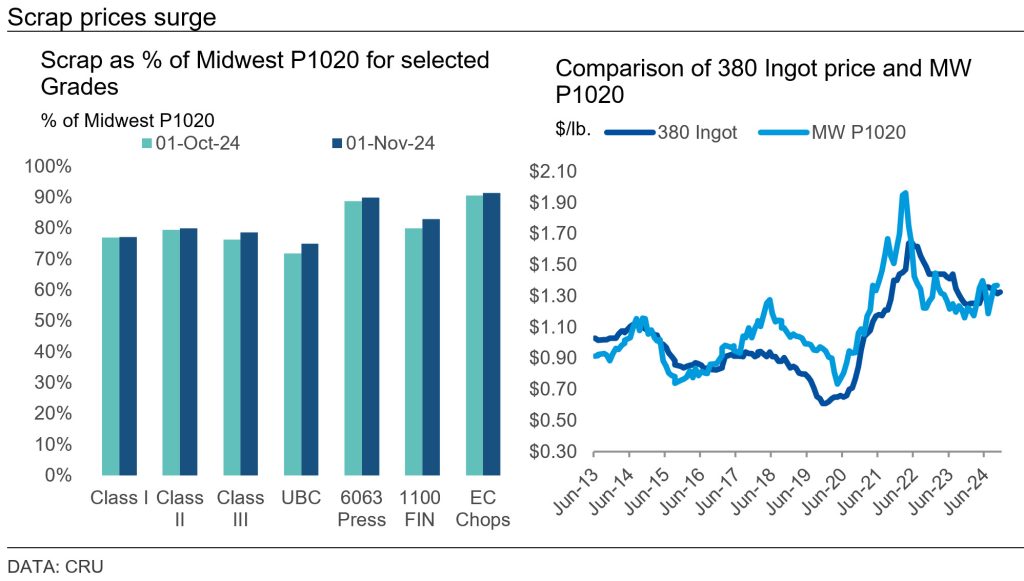

Scrap prices continue rising mostly driven by market tightness. For instance, prices of class 1, 2, and 3 scrap were last traded between 77-90% of U.S. Midwest P1020, showing 0.1-3.4% increase m/m. Similarly, the price of UBC as percentage of Midwest P1020 saw 3% increase m/m. The biggest price pickup was for 6063 grade that faced around 7% increase m/m.

This article was first published by CRU. To learn more about CRU’s services, visit www.crugroup.com.