Market

April 16, 2024

Housing starts slip to seven-month low in March

Written by Brett Linton

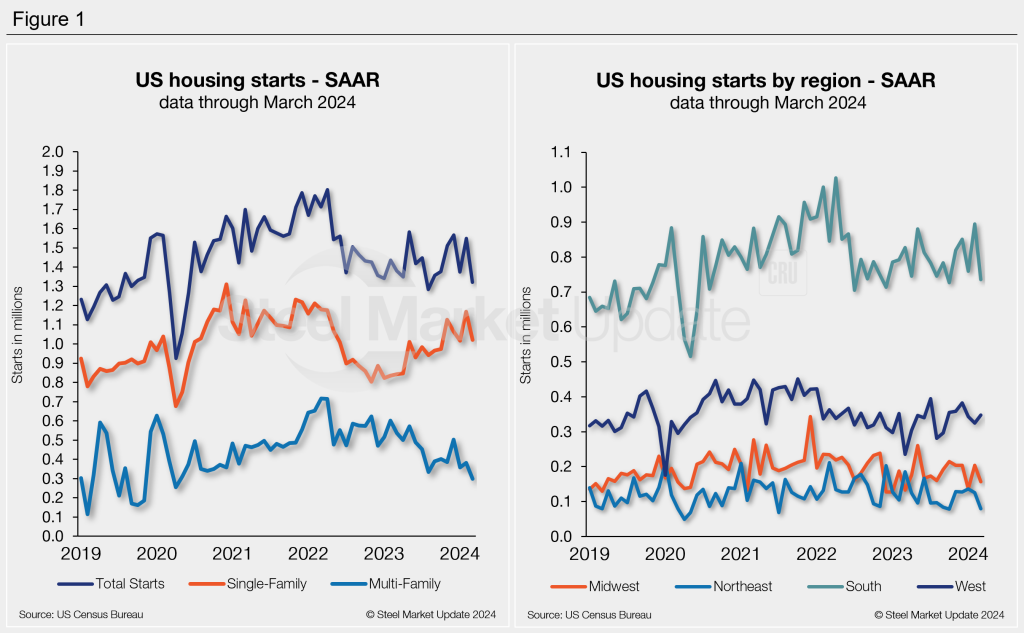

Following a strong February, U.S. housing starts eased through March to a seven-month low, according to the most recent data from the U.S. Census Bureau.

This decline is accredited to higher-than-expected interest and inflation rates, as well as higher supply costs and tighter lending conditions for builders, the National Association of Home Builders (NAHB) said.

Total housing starts stood at a seasonally adjusted annual rate (SAAR) of 1,321,000 units in March, a 14.7% reduction from the revised February estimate, and 4.3% below the March 2023 rate, Census said.

Single‐family housing starts in March were 1,022,000, down 12.4% from the revised February figure of 1,167,000.

“Builders are grappling on several fronts as the inflation fight continues,” Carl Harris, chairman of the NAHB, said in a statement.

“Higher interest rates are increasing the cost of housing for prospective home buyers and raising the development and construction cost for builders of homes and apartments,” he added.

Regionally, combined single-family and multi-family starts were mixed across the nation month over month (m/m). They fell 21.7% in the Northeast and 0.4% in the South, while starts rose 6.0% in the Midwest and 14.0% in the West.

At the same time, the overall number of privately owned housing units authorized by building permits fell 4.3% from February to March to a SAAR of 1,460,000. Single family building permits were 5.7% lower m/m while multi-family permits eased 1.2% from February.