Market

May 14, 2024

CRU: Buying frenzy for LME aluminum slows as warehouses see further large inflows

Written by Guillaume Osouf

Another large inflow of aluminum reported by the LME May 14

There was another large inflow of aluminum delivered into LME warehouses May 14. A total of 131,150 t was delivered again into Port Klang, Malaysia.

Given the total amount of cancelled warrants dropped by 15,300mt only since Monday, this suggests the majority of these deliveries were fresh deliveries as opposed to metal previously cancelled that moved back to live warrants. Tuesday’s flow adds to the large deliveries seen last week with a total of 425,575mt reported May 9, with the majority also being fresh deliveries as judged by the smaller proportion of cancelled warrants falling.

If we can assume the re-warranting of some of these tonnages is linked to the new sanctions introduced by the UK last month, the fresh deliveries raise more questions. It will be interesting to see what the origins breakdown is, as this data is not available yet. Some media reports suggested a majority of that inflow was from Indian origins – something that may be confirmed at the next Country of Origin report released by the LME next month.

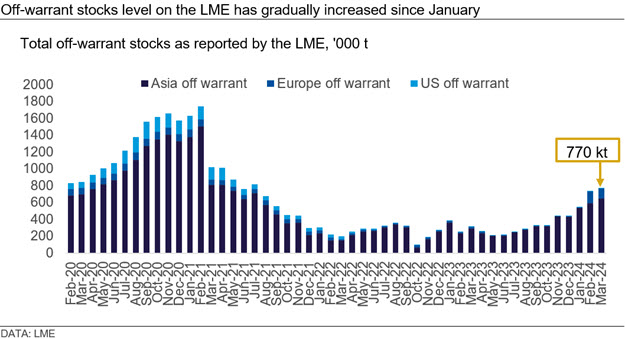

It is also interesting to note that the recent large inflows into LME-approved warehouses follow another large increase of off-warrant materials which started in January. First there was an increase of 104,711 t in January, to that there were an additional 195,949 t in February, and the last report shows an increase of 33,675 t as of end-March.

The majority of these increases were seen in Port Klang where 638,460 t of off-warrant is reported. Rotterdam saw also a noticeable increase by over 120,000 t in February, but this has declined since and the last reported figure is 101,348 t.

White House issues statement about higher 301 tariffs on Chinese imports

President Joe Biden announced an increase in tariffs Tuesday on Chinese EVs, semiconductors, batteries, solar cells, steel and aluminum.

“Following an in-depth review by the United States Trade Representative, President Biden is taking action to protect American workers and American companies from China’s unfair trade practices,” the online statement by the White House says before adding: “To encourage China to eliminate its unfair trade practices regarding technology transfer, intellectual property, and innovation, the President is directing increases in tariffs across strategic sectors such as steel and aluminum, semiconductors, electric vehicles, batteries, critical minerals, solar cells, ship-to-shore cranes, and medical products.”

The tariff rate on certain steel and aluminum products under Section 301 will increase from 0–7.5% to 25% in 2024, the statement says.

The White House justifies its decision by saying: “China’s policies and subsidies for their domestic steel and aluminum industries mean high-quality, low-emissions U.S. products are undercut by artificially low-priced Chinese alternatives produced with higher emissions. Today’s actions will shield the U.S. steel and aluminum industries from China’s unfair trade practices.”

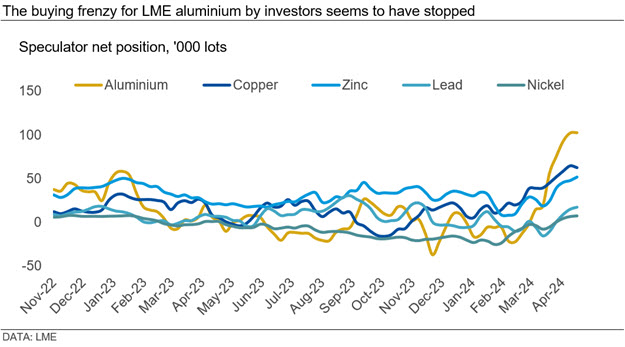

COTR update: Investors have lost appetite in LME aluminum as price declined

According to the latest Commitments of Traders Report (COTR) released by the LME, the net long position by investment funds remained steady at 102,900 lots. This comes as the longs reduced their exposure by 6,000 lots from the previous week while the shorts also cut their position by 6,400.

This latest report is interesting because this is the first time we see a reduction in long positions since the middle of February – well before the price started to rally. This suggests investors start to believe prices may have reached a peak as we are now over $200/t lower than the recent peak of $2,752.16/t reached May 1.

While it appears unlikely that the price will revisit the peak of 2023 in the short-term ($2,679.5/t), the attention should now be focused on the support levels. The current support level of $2,545/t (78.6% retracement of the 2023 downtrend) has been broken last week although the price is currently trying to regain the level.