Market

August 20, 2024

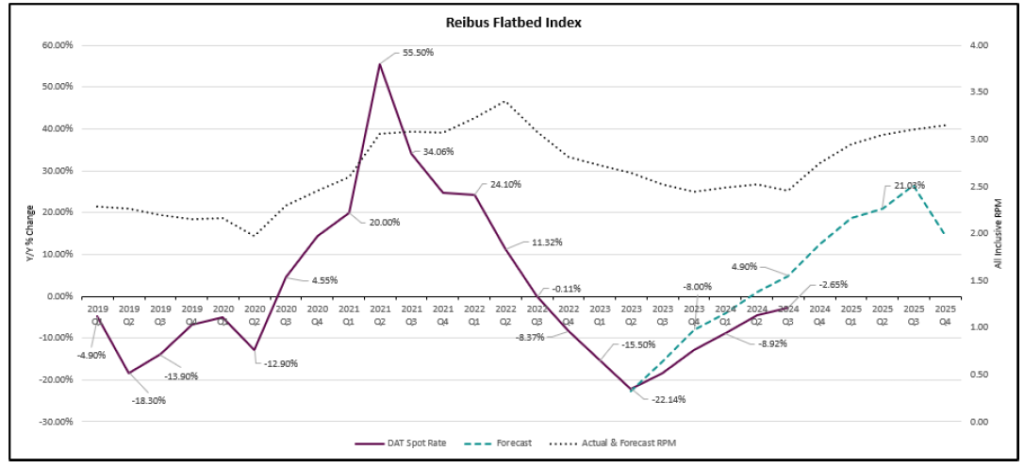

Reibus: Trucking pumps the breaks as transportation winds down

Written by Robert Martin

As is typical of August, the market has been very quiet thus far.

As has been the case in recent years, American workers take time off in July and August before school starts back up. The economy takes a bit of a breather, and ramps back up in September and October in anticipation of peak retail season, as well as Thanksgiving- and Christmas-related shipping.

So far in August, flatbed rates have fallen 1.6% month-over-month (m/m), dry van rates have fallen 2.0% m/m, and refrigerated rates have dropped 1.8% m/m. In terms of shipment volumes, July represented a nice bounce on a m/m basis, rising 3% from June, but volumes were still down 1.1% compared to 2023 and down nearly 10% compared to July 2022, according to the Cass Freight Index.

Based on our early August data, we are willing to wager that we will see a pullback in volume from July. However, as alluded to at the top of the article, that is not abnormal for August, and on a seasonally adjusted basis, we could see continued positive momentum.

We continue to operate in a marketplace that is oversupplied and keeping freight rates well under control. While this is a positive for shippers, it is not so good for carriers.

Overall trucking employment numbers continue to decline as carrier capacity undergoes attrition due to poor market conditions. Transportation jobs fell by 2,400 in July, marking the fourth consecutive month of declining employment. Over 12,000 jobs have been lost since April and 30,000 since last July. Capacity continues to exit the marketplace slowly when compared to previous cycles and overall supply levels remain elevated by historical standards. As spot rates remain well below the operating costs for private and dedicated fleets, it is reasonable to anticipate shippers will pull back investment in this type of capacity and a portion of overall demand will begin to shift back to the for-hire, over-the-road market.

On the demand side, import levels are strong and we are starting to see these volumes impact rail and intermodal capacity in certain markets, most notably, Southern California.

Looking ahead, potential East and Gulf Coast port strikes in October could result in volumes being shifted to the West Coast, thus exacerbating the already elevated levels of demand we’re currently witnessing. High import volumes are partly from retailers preparing for a potentially strong 2024 peak retail season, and while this data is encouraging from an economic perspective, retail forecasts are not always an accurate indicator of future demand. If retailers overshoot in Q4, it could lead to an inventory glut, similar to what we witnessed in the post-COVID era, which would put downward pressure on shipping rates.

Macroeconomic conditions are improving, and headline inflation has fallen below 3% for the first time since 2021. Markets are now pricing in the high likelihood of a 25-basis point rate cut at the Fed’s September meeting, with the potential for a 50-basis point cut not out of the question. This is good for consumers and should drive long-term demand trajectory upwards. There will not be any immediate impact on freight rates but if the economy heats up in Q4 and into 2025, an increase in demand will boost what is projected to be an already inflationary rate environment.

Freight rates are following typical seasonal trends in Q3, rising around the Fourth of July and declining steadily thereafter. It remains to be seen whether we will see any marked uptick in rates due to peak season. Assuming prices continue to follow seasonal trends, we will see rates begin to bounce back in the next few weeks and into September and October.

That being said, the past four years in logistics have been anything but typical so we continue to be prepared for anything.

Editor’s note: The views, thoughts, and opinions expressed in the content above belong solely to the author and do not necessarily reflect the opinions and beliefs of Recycled Metals Update or its parent company, CRU Group.