Market

May 17, 2024

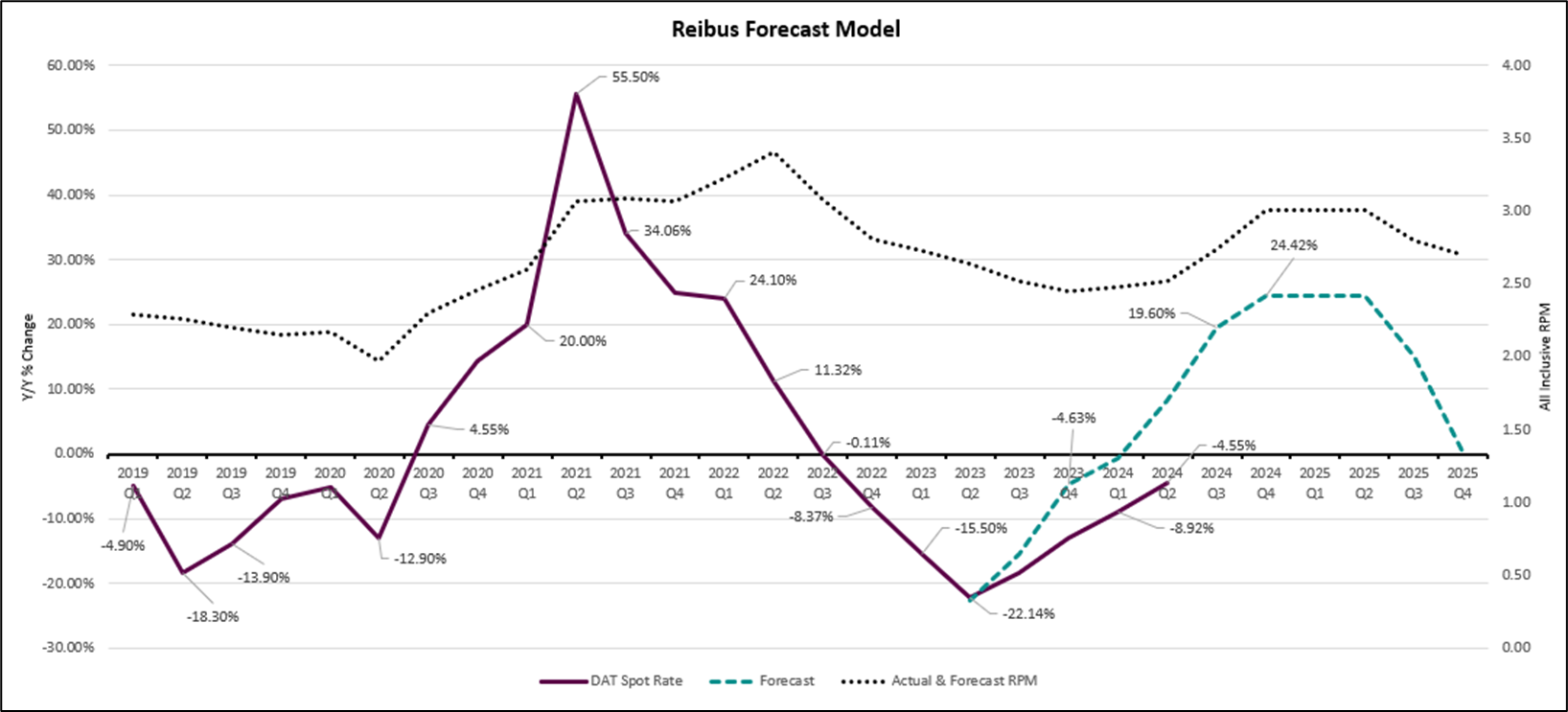

Reibus: Flatbed, dry van rates are sideways and 'somewhat boring'

Written by Robert Martin

Flatbed update

Roughly halfway through Q2, flatbed rates are holding firm, currently showing no change from April to May and a slight increase quarter over quarter (q/q).

The increase amounts to +1.6% q/q so there’s nothing to write home about for carriers just yet.

It remains to be seen whether the annual CVSA Roadcheck or seasonal demand patterns will be enough to give rates any real lift. No Black Swans thus far in 2024. Our potential accelerators and decelerators remain unchanged.

Dry van update

On the dry van side of the market, rates are also moving sideways. Rates are flat from April to May and down slightly q/q. Dry van rates appear to have found the floor but continue to stay there, bouncing along the bottom with little movement over the past six months. Spot rates have moved within a nine-cent margin for the past 14 months, marking a calm and somewhat boring market by historical standards.

Active brokerages continues decline

After a stark mean reversion from pandemic-driven highs, rates have remained as stable as they’ve been in the past two decades. Following a significant increase in active brokerages from late 2020 to early 2023, the number of active brokerages is also reverting toward the mean and trending back in line with long-term trends. This adjustment appears healthy as overall supply in the marketplace continues to rationalize.

From the April LMI

The Logistics Manager’s Index (LMI) reads in at 52.9 in April. This is down (-5.4) from March’s reading of 58.3, which was the highest rate of growth in 18 months.

While this still indicates growth in the logistics industry, this breaks what had been four consecutive months of increasing rates of expansion and is the slowest rate of growth observed so far in 2024. The slowed pace of growth is driven by a significant decrease in the expansion of Inventory Levels (down 12.8 points to 51.0, which is the most marginal level of expansion). This has cascading effects across the supply chain, as lower levels of inventory led to a loosening of both Warehousing (+9.4) and Transportation (+1.8) Capacity, slower expansion for Warehousing Utilization (-8.5), and most importantly, Transportation Prices moving back into contraction at a rate of 44.1.

There had been signs that the transportation market was moving back towards equilibrium. However, with the movements in our transportation metrics, Transportation Capacity is now 17.3 points higher than Transportation Prices (61.4 to 44.1) indicating that we are still firmly in a state of freight recession.

Class 8 truck orders

Historically, class 8 truck orders have represented the backbone of the market capacity cycle that drives transportation rates.

There have been sporadic order patterns in recent years that have bucked the traditional norm. Over the last few months, we appear to be returning to more normal order patterns, with demand falling off as transportation rates have remained suppressed.

Orders for April came in at 14,000 units, representing a 28% m/m decline. We would expect this trend to continue as capacity continues to exit the marketplace and not to reverse itself until we see a rally in spot rates, followed by an eventual rally in contract rates.

Macro economy

When zooming out and looking at the economy as a whole, consumers remain optimistic that we could see rate cut by year’s end. For that to happen, inflation will need to show strong indicators of moving toward the Fed’s target.

In April, wholesale prices rose 0.5% m/m and came in 2.2% higher on a 12-month basis, the largest gain in a year. Core PPI also rose 0.5% m/m compared to an estimate of 0.2% by Dow Jones economists. Overall, CPI remains stubbornly high, coming in at 3.4% in April on a 12-month basis. While inflation has certainly moderated compared to recent years, it remains well above the Fed’s stated target of 2%.

To see the full report or for further details and inquiries, reach out to Reibus Logistics and the author Robert Martin at robert.martin@reibus.com.

Editor’s note: The views, thoughts, and opinions expressed in the content above belong solely to the author and do not necessarily reflect the opinions and beliefs of Recycled Metals Update or its parent company, CRU Group.