Market

July 30, 2024

RMU Survey: Is the scrap market in balance?

Written by Gabriella Vagnini & Stephen Miller

When reviewing RMU’s monthly sentiment survey, the hot topic was staring us right in the face. Where is the balance in the market?

The question, “Do you see the scrap market being in balance now, given supply and demand?” With the majority, 55%, of the survey responders don’t believe the market is in balance. Comments from manufacturers “Demand is slightly lower than scrap return. Export is helping keep scrap pricing stable and higher than it should be”. Processors have commented that “Supply is short”, while traders and brokers stated “Global steel demand is depressed. May see a pick-up in Q4”. The consensus is that Q4 may experience a rise in steel scrap demand.

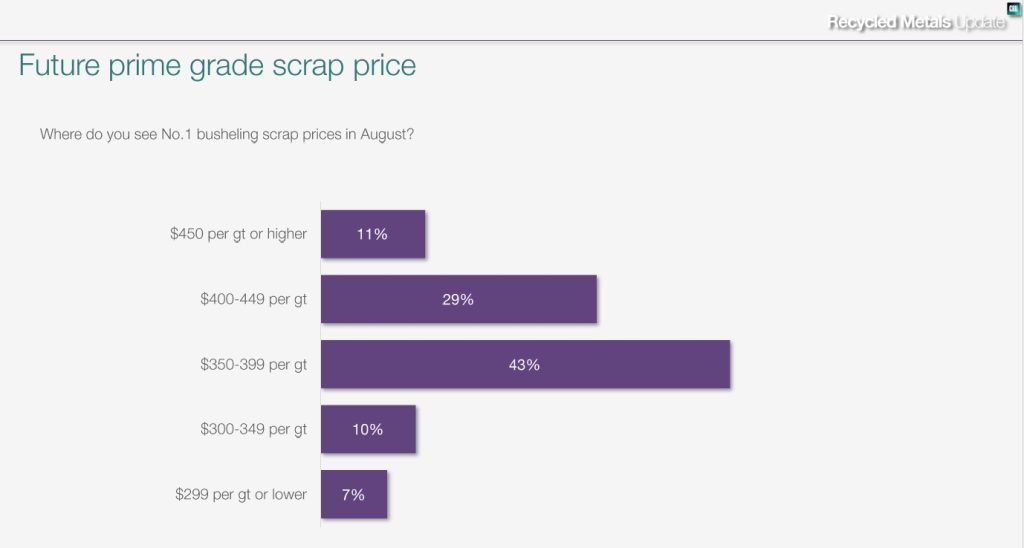

In the ferrous sector, Stephen Miller reported that RMU expects a price rally, as some processors are expecting a $20/gt increase in scrap for August. The market rising by $20/gt-30/gt in a month is not earthshaking, but if steelmaking improves in the coming months, the scrap market will go up significantly higher than these forecasts. These projected price surges happen usually as a result from declining prices for several months, as has been happening for 2024 to date.

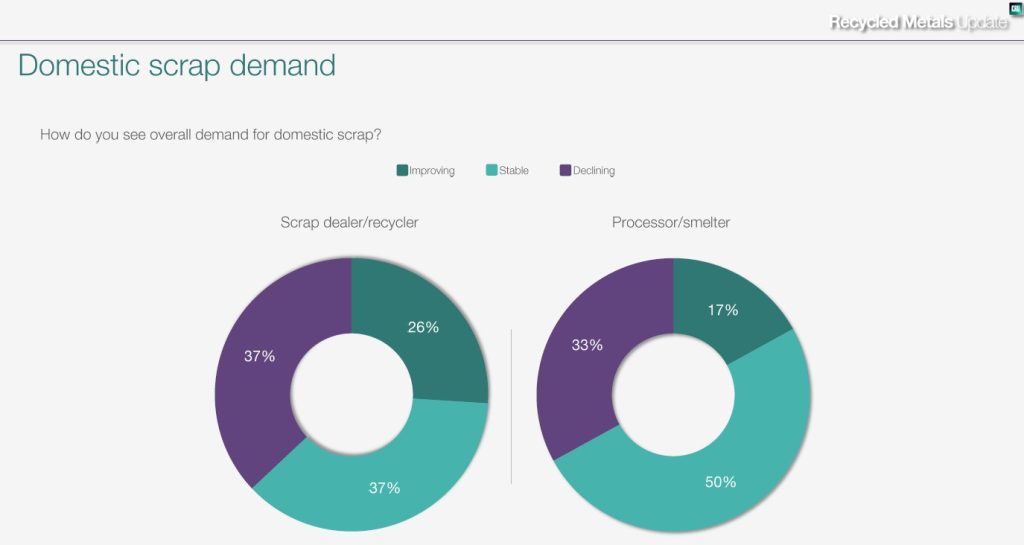

In terms of product demand, 61% report stable demand. While some companies have steady demand, others are experiencing declines, which vary depending on specific projects. As a major manufacturer stated that “We have one or two large players doing projects, everyone else is down significantly”.

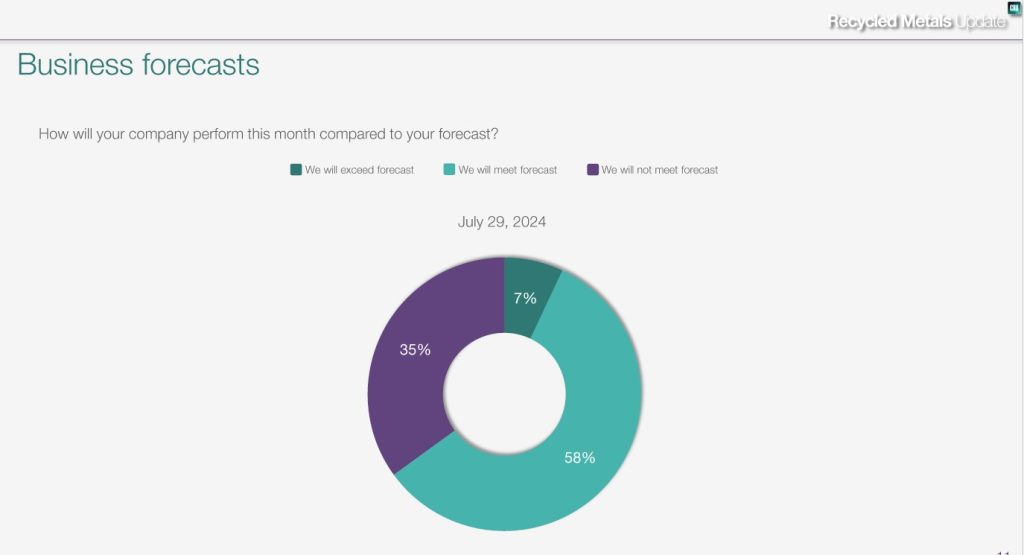

Regarding company performance, 58% expect to meet their forecasts, while 35% do not. Many firms have adjusted their expectations to align with the limited demand. Political unrest and slow supply are also impacting performance. The main obstacles to the proper flow and shipment of scrap include a strong USD and political uncertainty.

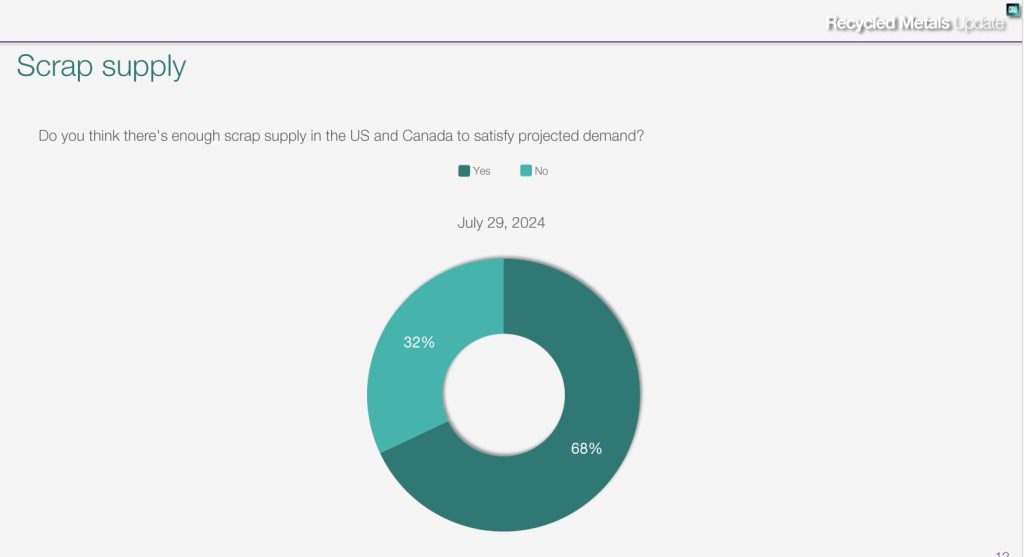

When surveyed about scrap supply, 68% believe it is sufficient to meet demand. Nevertheless, concerns persist regarding local reductions in scrap availability, depressed prices, and the effects of new mills.

A scrap yard observed a decrease in scrap metal availability in the area, coupled with reduced prices, diminishing the incentive for recycling. This lack of motivation to deliver scrap metal to yards could be considered a warning sign of an ongoing supply shortage.

Opinions are split on how export demand will affect domestic prices. About 49% think export demand will increase prices, while 41% believe it won’t have much effect, indicating that the impact depends on domestic demand and international factors.

For August, most expect busheling prices to range between $359/gt and $399/gt with potential for a slight increase, though some expect prices to remain flat. Ferrous scrap shipments are reported as stable by 58% of respondents, suggesting there’s no material shortage, and the market might remain steady.

Similarly, 62% expect ferrous scrap prices to stay flat, indicating stable scrap flow. Non-ferrous scrap shipments are reported as stable by 67% which typically improves at this time of year, and 52% expect non-ferrous scrap prices to stay flat due to continued high demand and low primary availability.

Domestic scrap demand is expected to remain flat by a combined 43% of respondents, and 62% expect export scrap demand to stay flat. Trucking logistics are found to be adequate by 61% of respondents, with plenty of availability. Rail logistics are also considered adequate by 59%, though some report a lack of options.

Last month, when the question about the upcoming trend in non-ferrous scrap prices was asked, the consensus predicted a 75% chance of stability and 25% change of an increase. However, this month, the tone has changed, the consensus for stability remains primary, but the expectation for an increase has dropped to 5%, with a combined 30% projection for a decrease.

There were several comments highlighting the lack of flow in the UBC market. With manufacturers stating that the UBC scrap flow had been reduced, identifying the scarcity is a primary challenge in the recycled metals industry, and improving consumer recycling rates is needed.

As the Midwest Premium (MWP) has remained flat for the last few weeks, it’s no surprise that the response from the survey reinforces the flat view going forward. With MWP currently at 18.80, we are right back where we start in the first week of this year.

Gabriella Vagnini

Read more from Gabriella Vagnini