Market

October 27, 2023

SMU Survey: Buyers Sentiment Indices Rise

Written by Ethan Bernard

SMU’s Current and Future Steel Buyers Sentiment Indices both increased this week, based on our most recent survey data.

Every other week we poll steel buyers about sentiment. The Steel Buyers Sentiment Indices measure how steel buyers feel about their company’s chances of success in the current market, as well as three to six months down the road. We have historical data going back to 2008. Check our interactive graphing tool here.

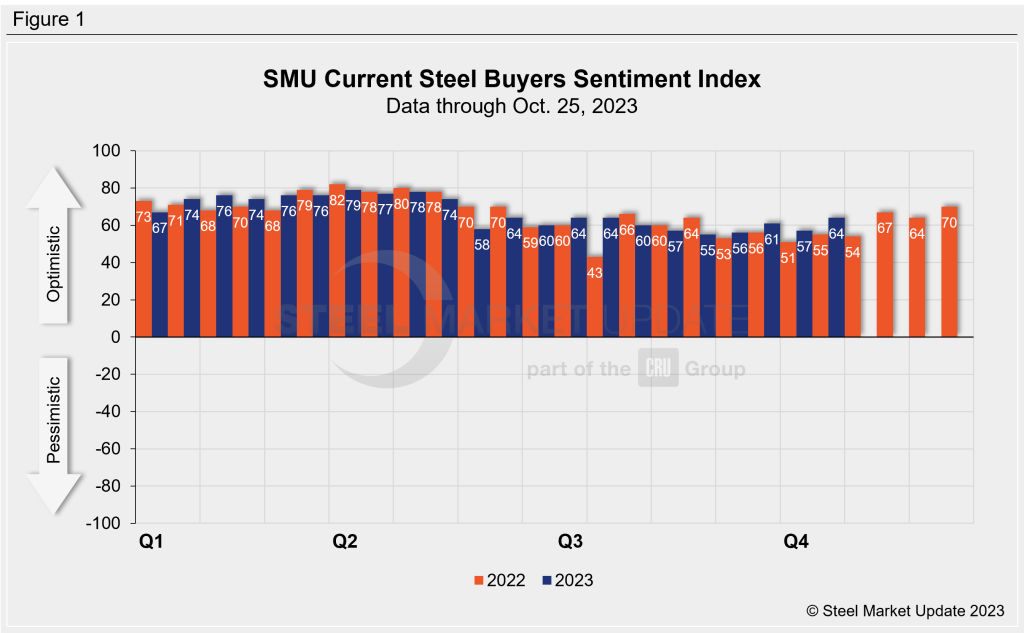

SMU’s Current Buyers Sentiment Index stood at +64 this week, up seven points from +57 two weeks prior (Figure 1). This is the highest reading since mid-July. Survey results were calculated before the tentative agreement was reached between Ford and the United Auto Workers union. However, the figure does include reaction to the recent wave of mill price increases.

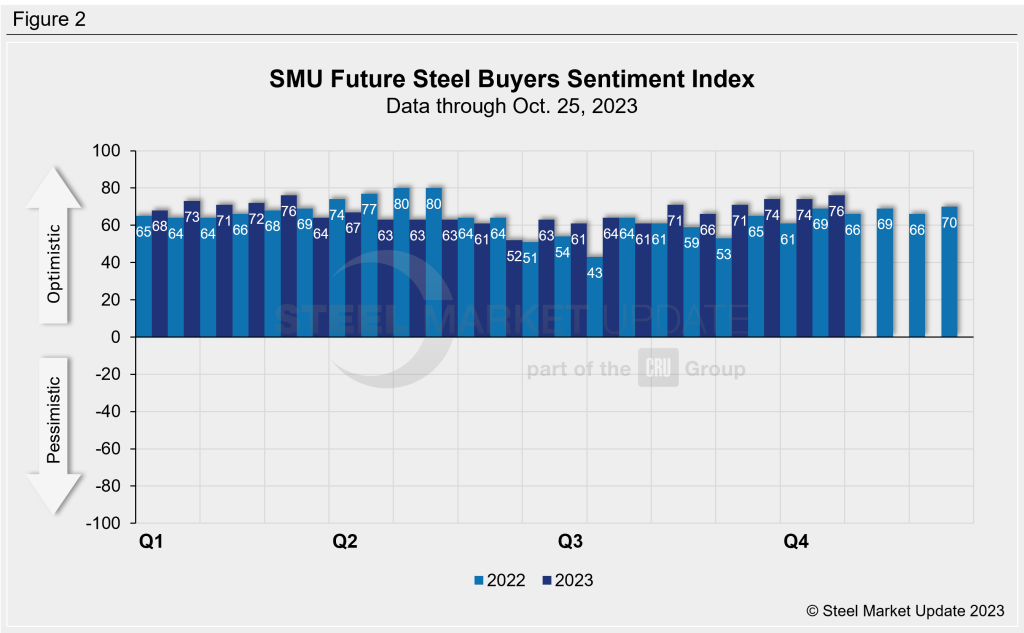

SMU’s Future Buyers Sentiment Index measures buyers’ feelings about business conditions three to six months in the future. This week, the index stood at +76, up two points from the previous market check (Figure 2). We have to go back to the beginning of March to find a reading this high.

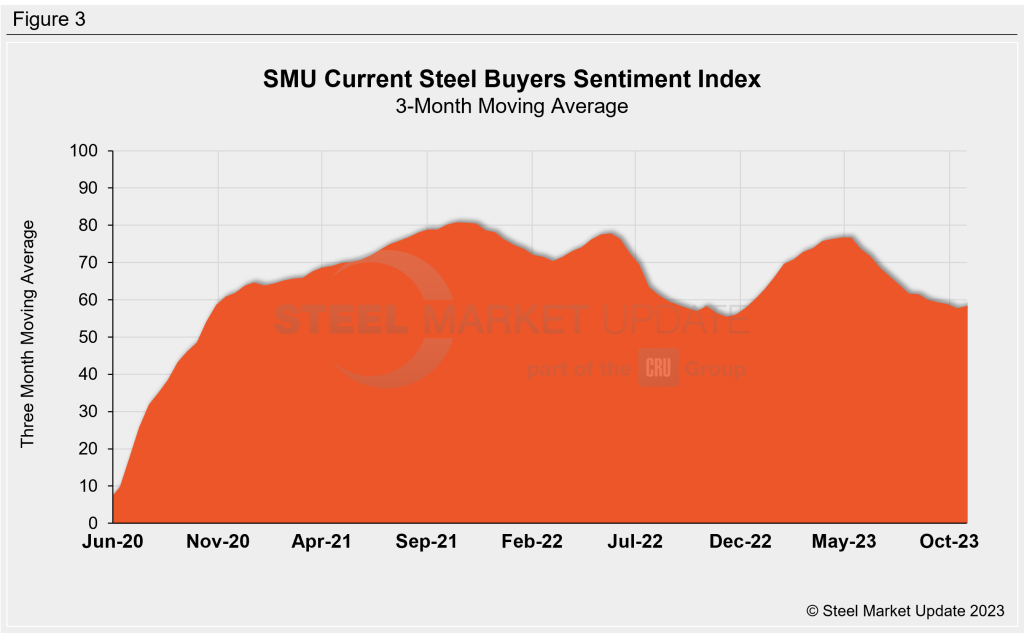

Measured as a three-month moving average, the Current Sentiment 3MMA rose to +58.33, compared with +57.67 two weeks earlier. (Figure 3).

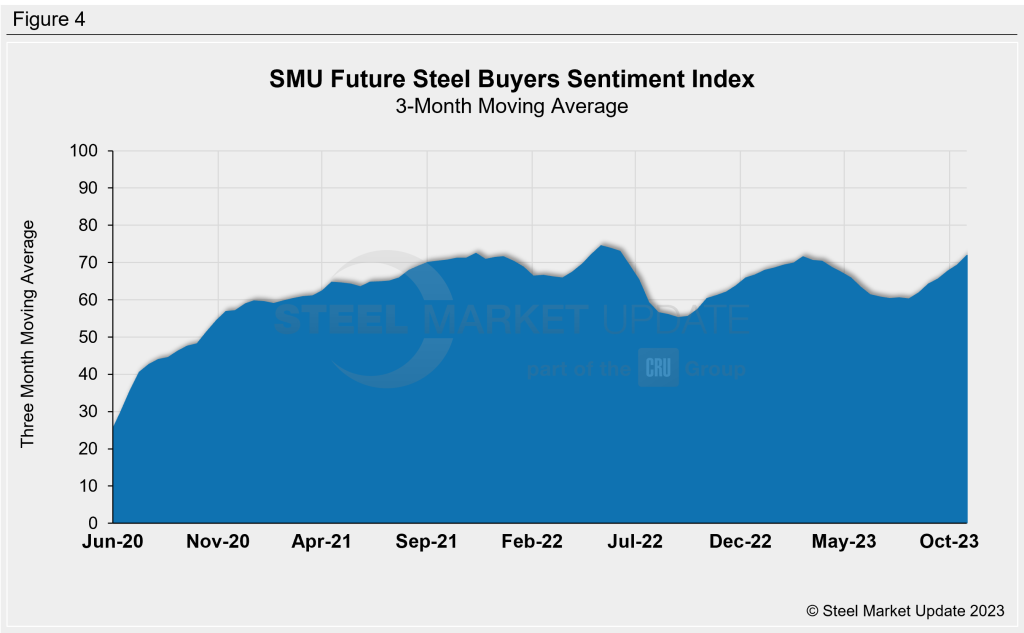

This week’s Future Sentiment 3MMA increased to +72.0 from +69.50 at the previous market check (Figure 4).

What SMU Respondents Had to Say:

“Rising market helps given our inventory positioning.”

“Some markets have been hit harder than others as far as demand goes. Overall, we are very stable.”

“Contract buying has picked up, with spot prices rising.”

“We are on pace to hit forecast for the calendar year. Our team did a great job at assessing where we thought the overall market would be this year.”

About the SMU Steel Buyers Sentiment Index

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior.

Positive readings run from +10 to +100. A positive reading means the meter on the right-hand side of our home page will fall in the green area indicating optimistic sentiment. Negative readings run from -10 to -100. They result in the meter on our homepage trending into the red, indicating pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace. Sentiment is measured via SMU surveys twice per month. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.

The post SMU Survey: Buyers Sentiment Indices Rise appeared first on Steel Market Update.