Prices

July 3, 2024

CRU: There is still a lack of momentum in the scrap market

Written by Marziyeh Horeh

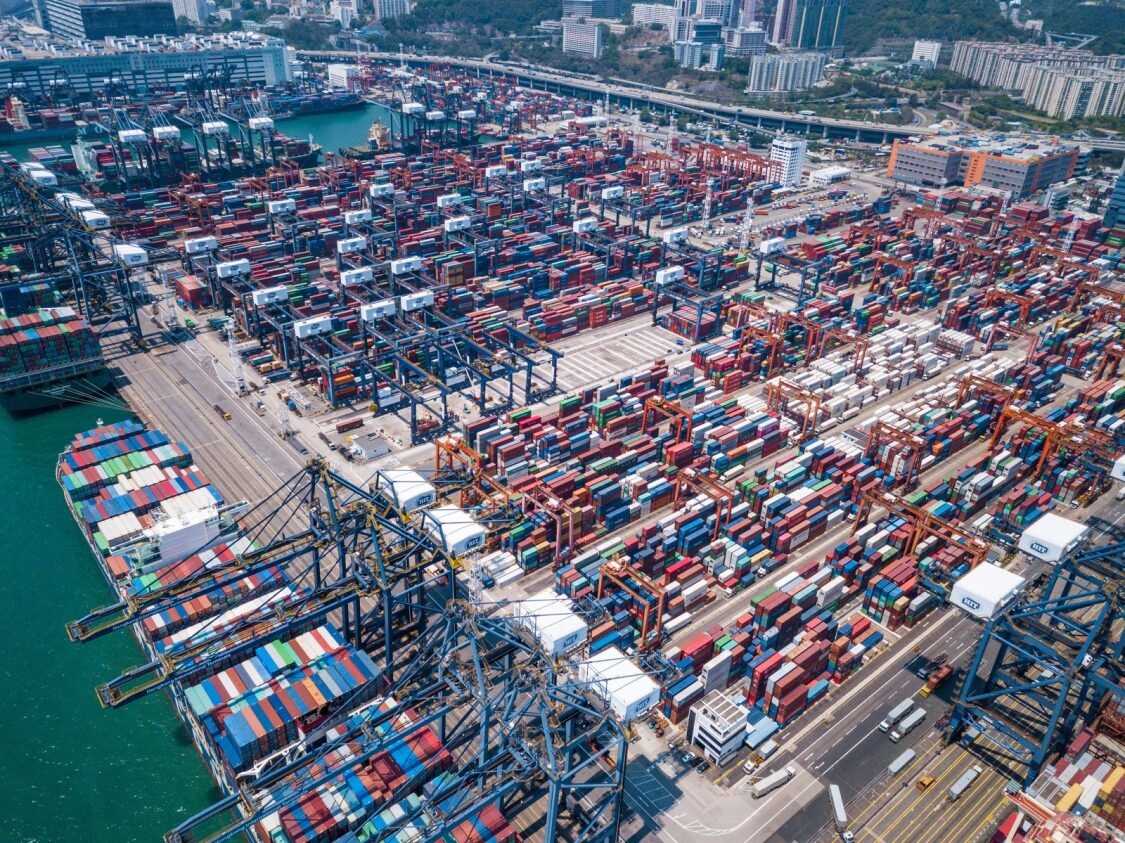

The aluminum scrap market in North America is tight and expected to remain so due to several factors.

Despite new aluminum mills coming online, there has been a recent scarcity of scrap, which typically keeps supply constrained.

Certain types of materials, like Used Beverage Can (UBC), are particularly tight, while higher purity materials are in short supply and highly competitive.

In contrast, cast alloys are more readily available. Yards are reporting slow activity. Demand is anticipated to remain soft throughout the year, reflecting overall weakness in manufacturing demand.

Despite challenges such as fluctuating market prices and operational hiccups, the market outlook remains constrained.

According to recent surveys by the Aluminum Association, class scrap receipts in May 2024 totaled 73.8 M/lb, marking a 23.8% increase from May 2023’s 59.6 M/lb.

Compared to April 2024, the total receipts saw a 0.3% fall over 74.1 M/lb. Year-to-date, receipts for 2024 reached 348.9 M/lb, reflecting a 12% increase over the same period in 2023 when 311.6 M/lb were recorded.

Scrap prices across most types moving down

Increase in exports to China

The main destinations for U.S. scrap exports remain India and South Asian countries. YTD data from Global Trade Tracker shows that India was the primary destination for U.S. scrap exports in 2024. YTD exports of U.S. scrap to India totaled 128 kt, marking a 6% decline compared to 2023. Malaysia ranked second among U.S. export destinations, with YTD exports totaling 120 kt, a 10% decrease from 2023. Thailand, the third destination, received 106 kt, reflecting a 64% increase. An interesting development in trade is the 158% increase in YTD U.S. exports to China, rising from 11 kt in 2023 to 27 kt in 2024. Likewise, Canada’s exports to China have also increased by 69%, climbing from 10 kt in 2023 to 16 kt in 2024.

Despite recent market tightness having pushed scrap prices up in recent months, it appears that the shutdowns associated with the 4th of July break appear to have dampened some of the demand for scrap. Consequently, we are seeing a retreat albeit a shallow one on some scrap types.

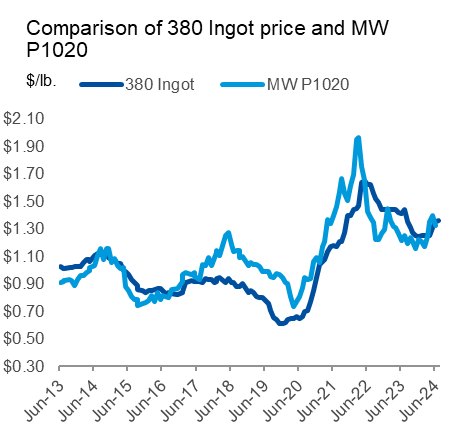

This weakened demand caused by July 4th shutdowns has resulted in lower average price of most types of scrap compared to the previous month. For instance, UBC price is around $0.97 /lb. The average price of 380 ingot, 319 ingot, 356 ingot, and old sheet/cast are at $1.36, $1.465, $1.64 and $0.845 /lb levels, respectively. 6063 press scrap was last traded around $1.055 while E.C. chops are reported to be at $1.155. Painted siding and Litho scrap moved down to $0.945 and $1.02 levels. Class scrap traded between $0.995-$1.055 depending on the type of class.