Scrap Consumers

April 18, 2024

CRU: Alcoa reports wider loss but sees improved market conditions

Written by CRU

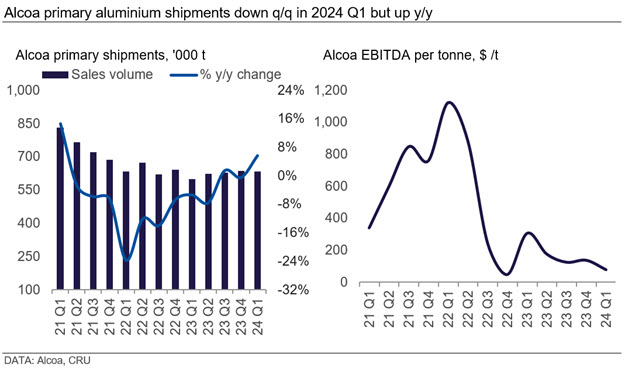

Alcoa released its quarterly results for 2024 Q1. The group posted an adjusted EBITDA of $132 million, down 45% y/y amid revenue of $2.5 billion, down 2.6% y/y. This led to a net loss of $252 million, wider than the loss of $231 million reported last year.

Among the key developments over the quarter, Alcoa said that it finalized the terms of its acquisition of Alumina Limited and initiated the process for the potential sale of the San Ciprián complex. It also said that it restarted around 6% of the pots at the smelter but judged the business as “unviable” in the long run and blamed the lack of government support.

Furthermore, the producer also completed the restart of one potline (54 kt) at its Warrick operations and announced the curtailment of its Kwinana refinery in Australia to be completed in 2024 Q2.

“In the first quarter of 2024, we finalized the terms of our acquisition of Alumina Limited, which will bring strategic, operational, and financial flexibility,” said Alcoa President and CEO William F. Oplinger. “Raw material prices and markets are improving, and we are implementing near-term improvements to further strengthen Alcoa for the future.”

Primary production totaled 542,000 t, which Alcoa said was consistent with 2023 Q4 and shipments were down 1% sequentially. As for the lower revenue y/y, Alcoa said it was driven by the lower aluminum price and the impact of the Alumar smelter restart hedge program which ended in December 2023. The group also blamed the timing of shipments.

Finally, the wider loss both q/q and y/y was caused by higher production costs, Alcoa said, although the price of energy and raw materials dropped. Additionally, the company said there was a charge of $197 million related to the curtailment of the Kwinana refinery. Furthermore, there was another charge to tax expense of $152 million to record a valuation allowance on Alcoa World Alumina Brasil deferred tax assets in 2023 Q4.