Prices

April 12, 2024

Questioning long held scrap price ‘realities’

Written by Philip Hoffman

Does the price of ferrous scrap depend on the price of finished steel product? And how much of an affect do billet and slab prices have on scrap prices?

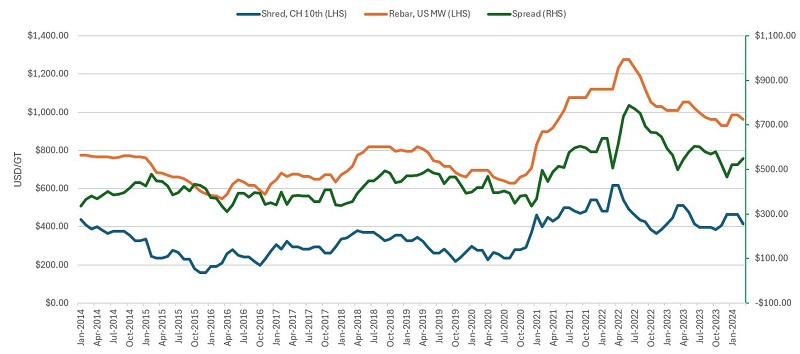

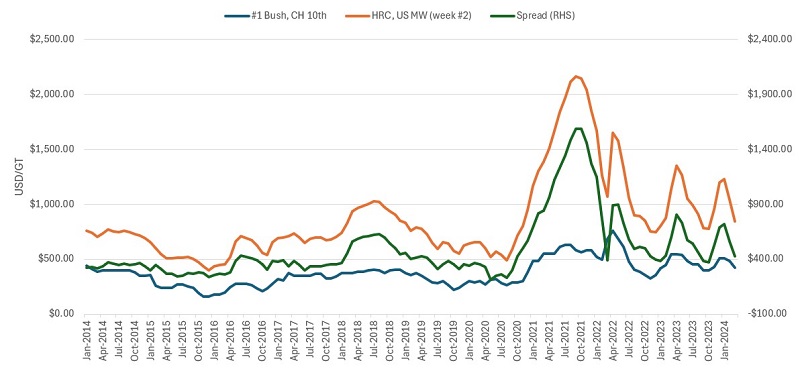

Starting October 2020 for HRC and January 2021 for rebar, the spread between ferrous scrap prices and finished steel prices have been historically high, which prompts the question: Is there a direct correlation between the price of finished steel and the price of ferrous scrap?

What’s at play

Scrap suppliers know that every time there’s downward pressure on finished product pricing steel mill, purchasing agents use it to justify decreases in their scrap buying prices.

Alternatively, when steel prices go up you can hear a pin drop from mill buyers on scrap price increases. When pressed, mill buyers reply that scrap is a stand-alone market that is affected by both global and domestic forces, pig iron, DRI/HBI, oil prices, the war in Ukraine, etc.

To add more uncertainty, when scrap prices go up mills often add a scrap surcharge to their finished product prices. That means the two are, in fact, directly related, opposing reasoning in an attempt to achieve a beneficial outcome for steel mills. Mill purchasing agents are doing a good job of buying scrap the mill needs at the lowest possible price, and the data backs that up.

Price trends

In the U.S. we are inundated with numerous statistics on how construction, durable goods and auto manufacturing is down, which reduces steel demand and leads to lower steel prices and the logical conclusion – demand for scrap will decrease and scrap prices will drop. Still, how much of an influence do finished product prices and the availability of scrap melting substitutes (such as billet and slab) actually impact scrap prices? The surprising answer is not much.

The above charts show that the price trends of scrap do reflect the price of steel. But a closer analysis shows us the distinct separation of the two.

For example, from September to November 2020, busheling was at $300 to $346 per gross ton while HRC went from $568/gt to $728/gt, increasing the Bush/HRC spread from $268/gt to $382/gt in just three months.

Was this a one-time anomaly? No.

Between May and August 2021, busheling went from $603/gt to $654/gt (+$51), while HRC went from $1,550/gt to $1,911/gt (+$361), raising the spread to $1,257/gt. To zoom in, September of that year showed busheling fell from $590 to $575 (-$15), while HRC drifted from $1,955 to $1,920 (-$35) to yield a $1,345 Bush/HRC spread. A close analysis of the shred/rebar price charts shows the same distinctions between the price of scrap and the price of finished steel.

So, while there is a correlation in the trend lines, scrap in no way moves up or down to the extent that steel prices do – and at times steel moves up and scrap stays flat or goes down; or scrap prices increase, and steel prices go down or stay flat.

Regarding the pricing data, a scrap source said, “The takeaway from this is that it’s end-product pricing that is driving the spreads, not raw material costs.”

Utilization rates factor in

One reason that scrap and steel prices are only tangentially related (that most mills will not reveal) is that the driving factor of scrap prices is that steel mills need to melt at a minimum 70% capacity utilization rate to cover their fixed overhead.

According to two separate mill owners in Turkey, “We need to melt at a minimum 70% capacity, or we will lose money on every ton of steel we ship…70% is the breakeven rate we need run to cover our fixed costs.”

So, mills need to buy at least enough to run at 70%, and they like to buy and run at a higher rate to reduce their fixed costs per ton.

Substitutes on the market

Another argument used by mill buyers in Turkey and Asia is that cheap billet and slab from China/Russia (despite the sanctions on Russia) is being offered to Turkey. That makes it cheaper to reheat billet/slab than to melt scrap. This puts downward pressure on scrap prices. In Asia mills, echo that this cheap billet and slab from China is dumped throughout Asian nations, hurting scrap demand in Taiwan, Korea, Vietnam and throughout the region. Thus, they need to buy scrap at prices that match those low-priced billet/slab offers.

The reality is that most mills can only fill a portion of their rolling mill capacity by reheating billet or slab. While cheap billet and slab may be available, most EAF/IF producers only have the capacity to reheat billet/slab to produce 10%-30% of their rolling mill capacity.

At the end of the day, EAF/IF mills need and want to melt as much scrap as possible to reduce their per-ton fixed costs of production and to keep a steady, well-trained workforce fully employed.

What could be ahead

The information we are inundated with regarding HRC/Long product prices and the availability of cheap billet and slab – while not to be entirely ignored – should be met with skepticism when forecasting the price of scrap. Statistics show that scrap prices have more to do with the level of scrap inventory that each mill has at the end of the month; the amount of scrap needed to keep the mill at a run rate that minimizes per-ton production costs; and the supply of scrap available from the dealers to fill the mill’s needs.

In my opinion, May scrap prices are going to closely reflect the current scrap inventory. Dealers sold as much as they could into a falling market in April. It looks like many of them may not be able to deliver on those orders due to the reduced scrap flow resulting from the drastic price drop they made across the scale. If dealers cannot deliver their April orders, mills will be short and any attempt at price reductions will leave them below an acceptable utilization rate.

Except shred, due to its unusually close price to busheling, prices for most grades of scrap will not likely drop in May and could increase in some regions on unusually low-priced grades, such as HMS.