Market

June 25, 2024

RMU survey results for June 2024: key trends and challenges ahead

Written by Gabriella Vagnini

Survey reveals key trends and challenges in the recycled metals market

The latest survey of the recycled metals market reveals significant insights and trends that are shaping the industry’s current state and future trajectory. Here’s a summary of the survey results:

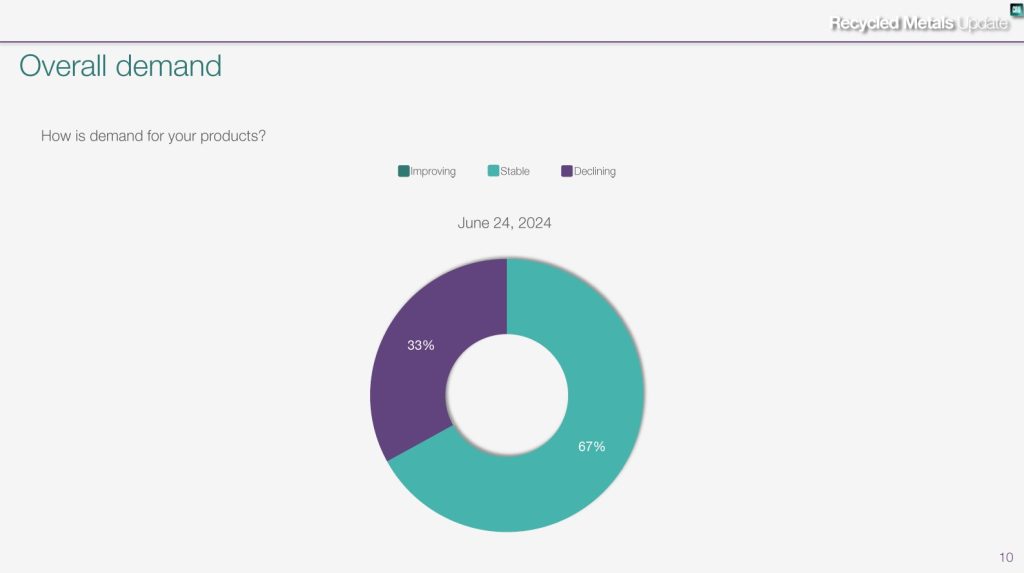

Product demand stability

Regarding the demand for products, most respondents described it as stable, although there were notable mentions of declining demand. Stable demand is attributed to the ability to sell all available scrap. However, rising interest rates are beginning to drain demand, adding a layer of uncertainty to future market conditions.

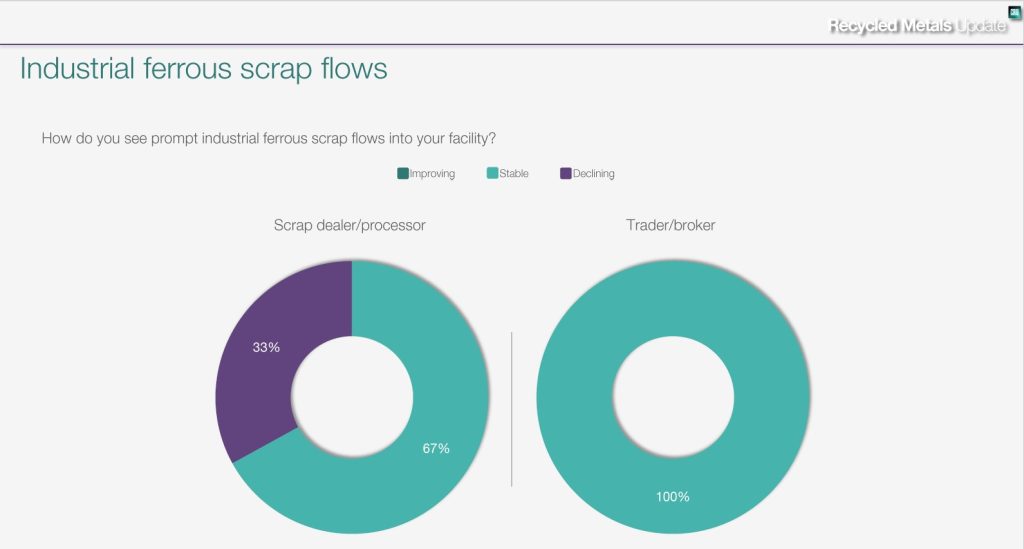

Obstacles in scrap flow and shipment

The survey highlighted several obstacles impeding the proper flow and shipment of scrap. Key challenges include the need for increased mill demand, improved export volumes, upgraded sortation processes, and economic confidence. Additionally, proper segregation and the need for greater demand for new steel were recurring themes among respondents.

Supply sufficiency in the US and Canada

Opinions on whether the U.S. and Canada have enough scrap supply to meet projected demand were mixed. While some believe the supply is sufficient for now, others express concerns about the availability of obsolete scrap and the impact of new plants coming online, which could increase scrap demand and strain supply.

Impact of export demand on domestic prices

The survey revealed varied expectations regarding the impact of export demand on domestic prices. Some respondents foresee an increase in domestic prices due to higher export demand, while others believe there will be no significant effect, as domestic demand alone cannot absorb the surplus.

Ferrous scrap shipments and price trends

Levels of prompt ferrous scrap shipments into facilities were generally reported as stable, although some noted a decline. For obsolete ferrous scrap shipments, the majority indicated stability, with a few reporting improvements. Future trends for ferrous scrap prices are expected to be flat or slightly decreasing.

Non-ferrous scrap shipments and price trends

Non-ferrous scrap shipments into facilities presented a mixed picture, with some respondents reporting stable levels while others noted a decline. Price trends for non-ferrous scrap are anticipated to remain flat, with some expecting a potential decrease due to fluctuating supply and demand dynamics.

Overall demand and logistic challenges

The overall demand for domestic scrap is seen as flat, with a slight decline in the demand for export scrap. Trucking and rail logistics for scrap movements were rated as adequate by most respondents, though some highlighted undersupply issues.

Mill pricing and strategic decision-making

When it comes to mill buyers pricing their monthly scrap purchases, responses were neutral to disagree. Similarly, opinions on whether mills employ strategic and long-range decision-making in formulating scrap pricing were mixed, with most respondents indicating a neutral stance.

Specific Price Projections

| Busheling | Expected to trend between $400-$449 per gross ton, driven by fewer available tons and increasing pig iron prices. |

| Shredded Scrap | Spot prices reported ranged from $385 to $505 per ton. |

| 1 Busheling | Prices ranged from $395 to $495 per ton. |

| 1 HMS | Spot prices were around $320 to $330 per ton. |

Conclusion

The recycled metals market is navigating through a phase of oversupply as per survey responses, with stable but cautious demand. Economic uncertainties, operational disruptions, and logistical challenges continue to influence market dynamics. The insights gained from this survey highlight the need for agility and strategic planning to address the evolving challenges and opportunities in this dynamic sector. By staying informed and adaptable, the industry can continue to thrive and contribute to broader goals of sustainability and economic stability. View our in-depth commentary on these survey results here.

Add your voice to the discussion

Sign up to participate in future surveys here.