Market

August 19, 2024

LME aluminum rises, with focus on Fed Chair’s speech

Written by Guillaume Osouf

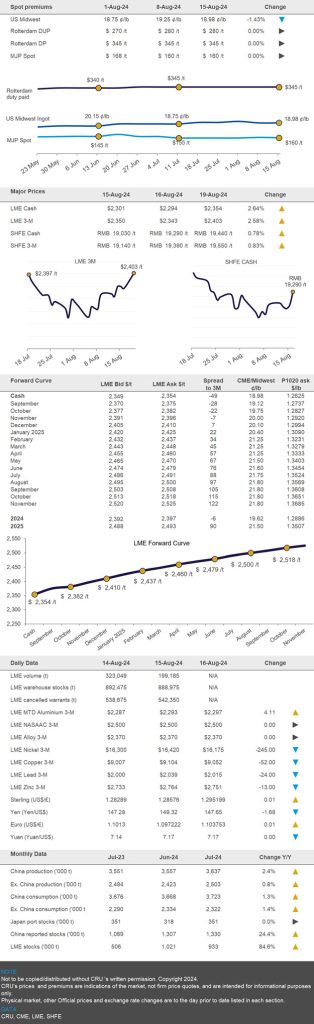

On Tuesday morning, the LME 3-month price was up again and was last seen trading at $2,473/metric ton (mt). The move has been mostly driven by a softer US dollar.

This week most of the focus will be on the Jackson Hole speech on Friday where Federal Reserve Chairman Jerome Powell is expected to set the tone for a September interest rate cut. The minutes of the last July FOMC meeting are also due this Wednesday.

The SHFE aluminum cash price also traded higher Tuesday. The cash price first settled at RMB19,630/mt and last traded at RMB19,645/mt.

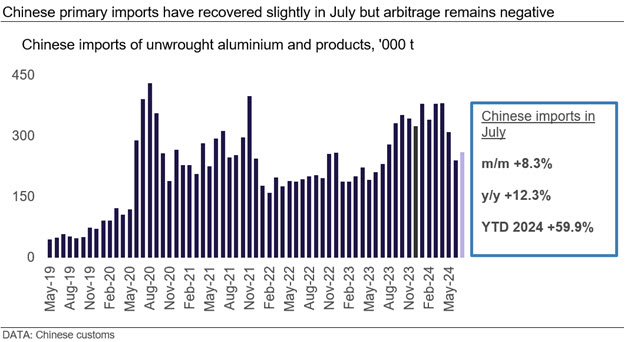

Chinese primary imports increase in July but remain weak overall

In July, China’s imports of unwrought aluminum and products increased to 260,000 mt, up 20,000 mt or 8.3% from June, and up 12.3% from the same month last year. The accumulated level of imports between January and July now totals 2.29M mt, still up close to 60% y/y.

Despite the higher monthly total in July, the level of imports is still significantly down from the peak of 380,000 mt reached in March mainly due to the closed arbitrage window since April. Indeed, the loss for primary imports averaged $120/mt in July, which is only slightly less than the loss of $130/mt averaged in June. We assume that imports of primary aluminum come mainly from Russia. Overall, China’s primary demand has weakened over the summer months, bringing higher stocks and therefore reducing the need to import primary metal from abroad.

Moreover, as a sign of the current subdued demand in China, the country’s aluminum semi-finished output declined by 6% m/m in July to 5.5M mt, but still up 5% compared the same period last year. This indicates that if Chinese downstream demand was weaker in July compared to June, it still remains better than last year. For the YTD period through to July, semis production across Chinese manufacturers still shows a 7% y/y growth.

Chinese primary output reaches a new record in July, but in absolute terms only

According to the latest NBS data, China produced a total of 3.68M mt primary aluminum in July, representing an increase of 5.75% y/y; and also, in absolute terms, a new monthly record for the world number one producer. However, in annualized terms this amounts to 43.4M mt per year, which is down from the annualized total of 44.7M mt reported in June. Indeed, in June the country produced 3.67M mt, but June has one day less than July. As for CRU’s estimation of primary output in July, we have a slightly lower number at 3.63M mt, which comes to an annualized number of 42.9M mt per year, also down from the number of 43.3M mt reported last month.

Primary production in the country will continue to be supported by new projects in Inner Mongolia which, we hear, are progressing well. In total, close to 1.5M mt of capacity could be added in the province by next year across various producers.

Nalco on track to meet annual aluminum production target

The Indian state-owned integrated aluminum company, Nalco, recently reported significant progress to its operations as it achieved 97% of its production capacity target as of August 16 for the current fiscal year.

Executive Director S. Subrahmanyam Neralla confirmed that 940 of the 960 pots at the smelter were operational, contributing to a total production of 170,000 mt so far, this fiscal year, which will finish at the end of March next year. Nalco has set an ambitious production target of 460,000 mt of aluminum for this financial year, with the aim to replicate last year’s output. Neralla also showed optimism that aluminum production will increase after the monsoon season, which occurs in September. He also noted that the company has a secure coal stock of 0.35M mt at its captive power plant, sourced from both Mahanadi Coalfields Limited (MCL) and Nalco’s two captive coal mines.