Market

August 26, 2024

Ferrous scrap prices on edge amid major mill outages- Full list inside!

Written by Stephen Miller

Earlier this month, many in the trade were disappointed that prices on ferrous scrap did not increase for August. But as of now most are concerned about September being weaker. The export market, which had held steady despite drops in domestic tags, deteriorated sharply in August. It may drop even lower as we finish out the month. The prevailing feeling is that prime grades could trade sideways next month and obsolete grades could drop $20/gt.

Let’s take a look at the factors influencing future market conditions

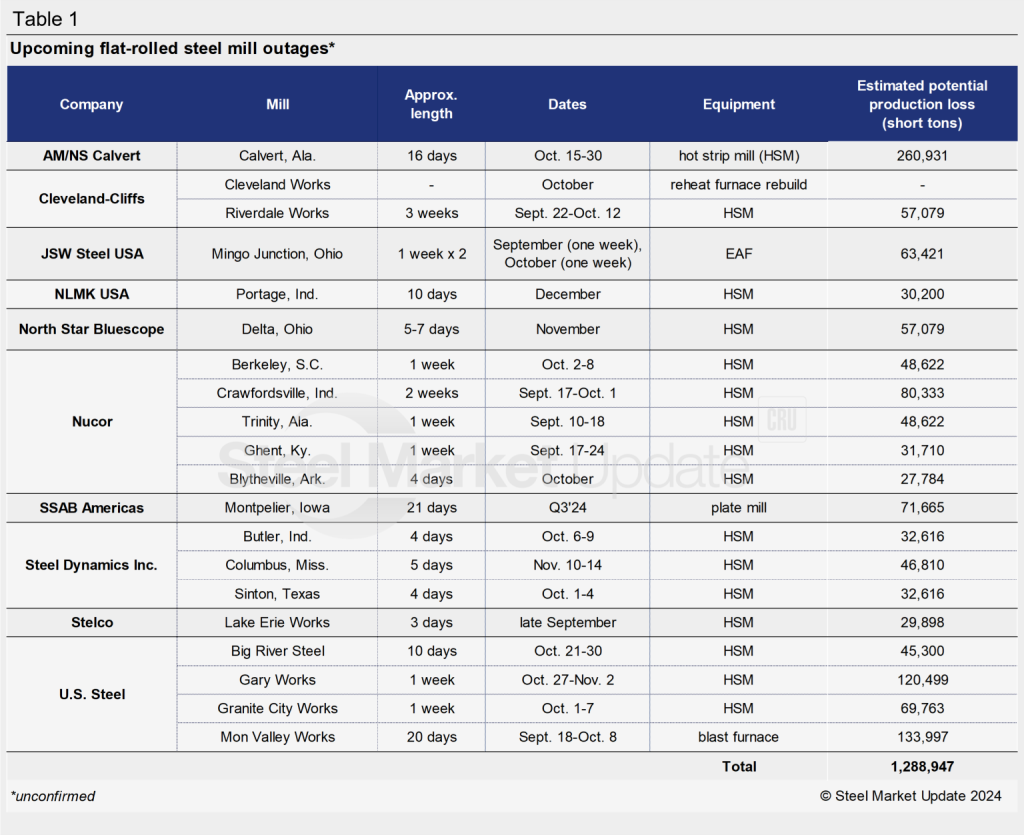

The main problem is that flat-roll products are in a slump and mills producing these products are presumably not running very well. In the meantime, there seems to be sufficient scrap available, especially since outages at steel mills are still being scheduled. See below list of steel mill outages as reported by Laura Miller at SMU. RMU reached out to a purchasing manager at a Great Lakes-based steelmaker to get his views for September. “With the number of outages on the horizon, I see no way for the market to improve. The outages may improve the need for steel, but scrap still feels plentiful. Dealers are having no issue taking and filling orders in a timely manner, and no mills are hurting for scrap.” He added, “I expect to see the market sideways at best.”

The export market has dropped a solid $30/mt since the start of the month. The main driver of this is the vast tonnages of cheap semi-finished steel, namely billets, being exported to Turkey by Chinese producers. As they undercut the cost of scrap use given the pricing levels of finished rebar, export scrap prices started to weaken. This decline can only be a bearish omen for the U.S. and Canadian scrap markets.

Last week, raw steel production was operating at about 79%, according to AISI. That’s right, 79%. This is the highest rate since 2022. The goal of the Trump tariffs and quotas were to get to 80%. So, our mills are running better and demand for scrap is falling out of bed. Someone has to explain this to me!

There is the threat of a railroad strike at the CN railroad in Canada. In fact, a strike was called by the Teamster’s Union but government arbitration ordered the strikers back to work. However, the union is still trying to implement a strike in defiance of the order. If there is a strike which lasts for than a couple of weeks, it could have a bullish effect on the U.S. scrap market since we receive considerable scrap from Canada, especially prime grades. Needless to say, Canadian mills would be in a pinch too.

So, September looks to be another month of weak scrap pricing unless there is some large event which could turn the tables. This is not very likely. Dealer resistance does not appear to be likely either, unless the mills become insistent on declines too severe for the trade to accept. In short, we are looking at another drop in prices.