Market

September 10, 2024

RMU's August survey shows shift in supply and demand sentiment

Written by Gabriella Vagnini

The survey starts with the simple question: Do you see the scrap market as being in balance now, given supply and demand?

While July’s survey showed 55% saying “no,” August participants seemed to change their tune, shifting to 57% saying “yes,” they do think it’s in balance. Could this be the sign of relief we’ve been waiting for? What makes people feel that in July we were off balance but now things are better? Is it wishful thinking or a solid view?

Let’s take a closer look at the rest of the survey responses, examine comments from the industry participants themselves, as well as analyze the total results of the survey, which may shed some light on this dramatic change of heart.

Scrap market imbalance

In a follow-up to the imbalance survey question, even though the survey shifted to a positive imbalance view, we did see one manufacturer adding this alarming comment, “the presses are running at 60%, so scrap isn’t being pushed through efficiently.” This comment is concerning because it validates what several sources have been saying: Industrial production, especially stamping plants, are cutting back. If the presses are all only running at 60%, steel sales would be down, and scrap wouldn’t be generated.

Another comment supporting the imbalance that drew our attention was from a major recycler. They listed that their major obstacle was “slower scrap intake at dealer yards.” Of course, we have been hearing it from yards here and there. However, from a major company, that’s a pretty huge sentiment. Let’s just hope that’s only due to the typical summer slowdown.

Still, one good reminder was from a trader who said, “Export prices declining. Election year which always affects the market.” While export prices are declining, as it was typically known to provide higher payouts than domestic, this decline in price and demand still stems from China’s ongoing issues, as reflected in a recent article by our parent company CRU Group.

As for election years, there are many variables up in the air. We can look at election years historically as causing significant changes. The potential shifts in economic policies, infrastructure spending, trade agreements, environmental regulations, and tax and tariff strategies could greatly influence the market’s trajectory, all contingent which candidate becomes the U.S. president.

It’s common for companies to postpone investment, expansion or purchasing decisions during this time. Additionally, the sustainability and tariffs under consideration impact demand and profits within the recycled metals industry. However, it’s important to remember that the president must work with Congress to enact substantial policy changes and must also navigate a complex environment to implement any significant alterations.

We keep hearing that this presidential election will be a tight race. I did find one poll interesting, and that was at the SMU Steel Summit in Atlanta last month (If you went, you know how great it was. If you didn’t go, you should start planning your attendance for next year!). One key takeaway that Michael Cowden wrote about in SMU’s final thoughts after the conference focused on a poll SMU ran on the U.S. presidential election. The results? According to industry people who attended the summit, 63% thought that Trump would win the election. Only time will tell who the true winner will be, but do keep the elections in mind when setting up your contracts for next year.

Export demand affecting domestic prices

Several respondents expressed concerns about the influence of export demand on domestic prices. For instance, one noted, “Export copper 3/5 cents higher than domestic,” signaling that export demand could push domestic prices higher in the near future.

However, we are seeing export prices falling due to China’s decline in interest and internal issues that were expressed in the CRU article referenced earlier. Although historically we’ve seen export prices higher than domestic prices, that’s just not the case currently. But we are seeing a shift in demand in billets and pig iron, which RMU’s Steve Miller wrote about last week, that starts to bring other countries into play and opens up stronger export and import options.

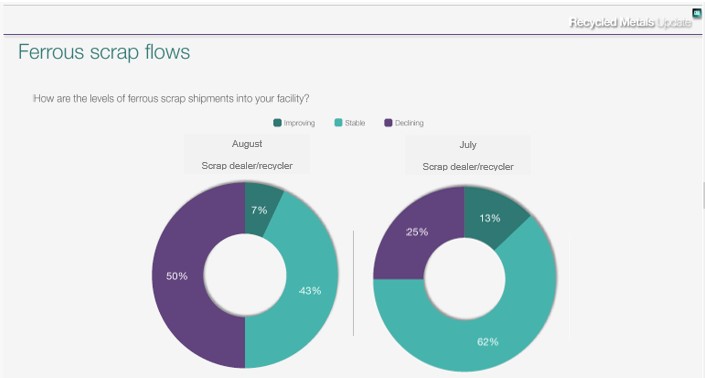

Ferrous scrap flows

While scrap dealers and recycling centers back in July showed 62% stability for the level of ferrous scrap shipments into their facilities, August surely painted a different picture. For August, they responded with a 50% decline of inbound shipments into their facilities. Only 7% saw shipments improving. The center flow of the market is on a downward trend. This further supports the downward trend in supply and demand and may indicate more challenging conditions ahead if this trend continues through September.

Transportation and logistics challenges

A common obstacle mentioned was transportation logistics, including “3rd Party Transportation services. Lack of planning and understanding on behalf of customer’s employees.” One scrap dealer said, “the railroads do whatever they want because they can.” While those are some market participant’s specific concerns, and understandable ones, we will note that we are seeing logistics come out of their slump since the Canadian rail issue got resolved and back on track (pun intended) and we’ve been told that local trucks have even started to come down slightly on their prices.

Domestic supply and demand

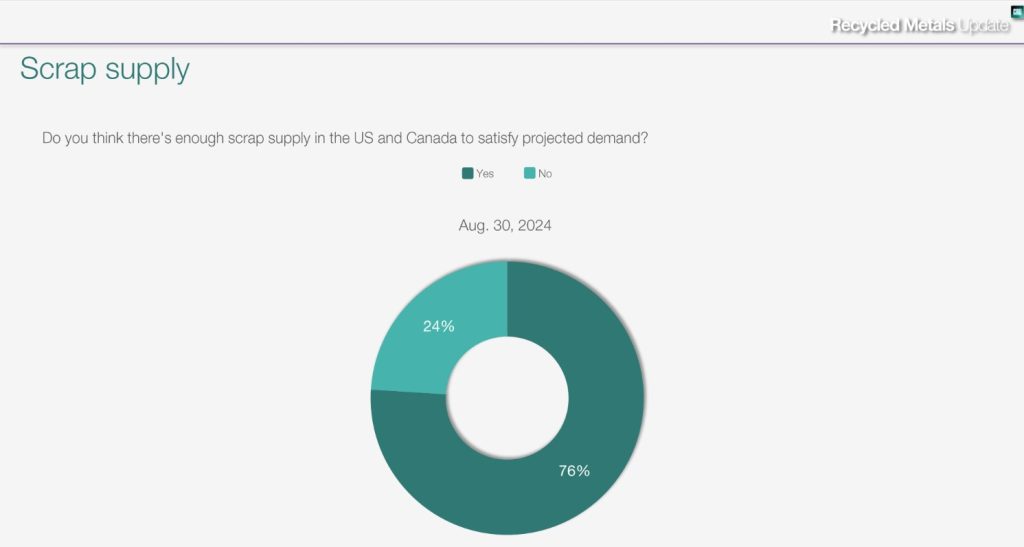

With all that said, some areas of the survey did show some positive sentiment, as 76% of respondents said there would be enough supply to support projected demand. One trader indicated “supply is steady and demand is still lower than expected.” However, a manufacturer shared that “muted activity during the majority of Q3 will cause buyers to place increased orders for Q4, thus lifting demand at the mills.”

With the support of supply and demand for ferrous scrap prices, 59% of respondents said prices will be flat, and 32% pointed toward a decrease. One manufacturer said that “maybe a touch up on shred/prime could see cuts sideways, some regions up a little on P&S.” Basically, the districts that dropped shredded prices were in error and that it will correct next month.

The recycled metals market feels steady for now, but there’s no shortage of challenges. Most people didn’t expect to hit their August forecast, with the survey responses pointing toward high transportation costs, shifting prices and global issues, all of which are keeping everyone on alert for next month during contract season. Some think export demand could drive prices up, but opinions are mixed for the most part. For ferrous scrap, supply and demand are in decent shape, based on responses in the survey, but non-ferrous scrap is more of a question mark. All in all, while the market isn’t without its bumps, people are cautiously optimistic and seem ready to roll with whatever comes their way.