Market

October 22, 2024

CBAM, tariffs & taxes: The good the bad and the ugly

Written by Gabriella Vagnini

If we look back at how aluminum trading worked in import and export five or 10 years ago, it was a whole lot easier and less costly than what we’re dealing with currently. Back then, trade was more about keeping the markets open and making sure the metal moved easily between countries. It wasn’t as complicated and costly as today’s tariffs, taxes, or new environmental rules, such as Europe’s Carbon Border Adjustment Mechanism (CBAM). These days, aluminum import and export trading are pretty messy, especially for the U.S.

The way it used to be: A much smoother ride

If you go back a decade, NAFTA was still in place, and it allowed the U.S., Canada, and Mexico to trade aluminum without much hassle. Aluminum flowed back and forth, and Canada, being the top supplier to the U.S., could ship aluminum south across the border without worrying about extra costs. Tariffs weren’t slapping aluminum shipments left and right, and the whole system was a lot more predictable.

At that time, the focus was on making trade easier, and tariffs weren’t the nightmare they are now. Aluminum moved between countries without a bunch of price hikes or rules, and businesses weren’t stuck paying extra fees. It wasn’t perfect, but compared to what is going on today, it was a lot less complicated.

Tariffs changed the game: Section 232 and payback

Things shifted in 2018 when the U.S. put Section 232 tariffs on steel and aluminum imports, claiming the need to protect national security. That added a 10% tariff on aluminum imports, including from Canada and Mexico. Naturally, these countries weren’t happy and fought back with tariffs of their own on U.S. goods.

The U.S. tariffs still exist to this day and President Biden took it a step further by adding some modifications such as tariff rate quotas to certain allied countries. What used to be a smooth trade setup became a lot more complicated. Countries started focusing on protecting their own industries, and it made the flow of aluminum a lot more uncertain and expensive. Did I mention that the U.S. imports 90% of their aluminum?

Europe’s CBAM: More costs piled on

If tariffs weren’t enough, now Europe’s got CBAM, which is all about making sure that imported aluminum (and other goods) coming into Europe meets strict carbon standards. Basically, if your aluminum has a bigger carbon footprint than what’s produced in Europe, you’ll get hit with extra taxes. So, if you’re a U.S. producer sending aluminum to Europe, you either have to clean up your act or face getting pushed out of the market because of the added costs.

This wasn’t something that came into play ten years ago, but now climate policies are a big part of trade. CBAM is forcing U.S. aluminum companies to either adapt or risk losing out, especially since Europe is a key market. It’s no longer just about how cheap aluminum is, but about how environmentally friendly it is.

Where we’re at now: A fragmented mess

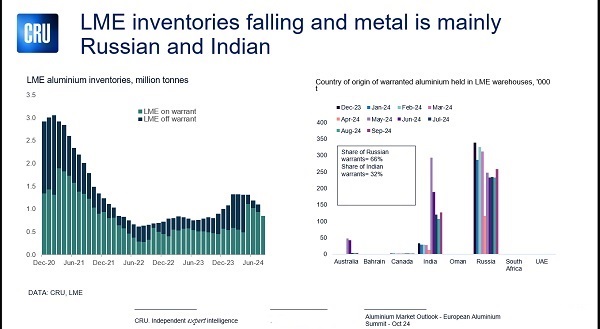

Right now, the aluminum trading, import and export, is more fractured than ever. Let’s take the London Metal Exchange for example. The metal in their LME-approved warehouses are supposed to be used as a last resort. As you can see in the chart below, supplied to us by CRU, you can see the massive decrease of metal both on and off warrant of the LME physical inventories. Without the metal on the exchange to back the trades, it has become a tighter and more aggressive market.

Countries like the U.S., Canada, Mexico, and those in Europe are all putting up barriers to protect their own industries, and that’s creating a lot of problems. It’s not about working together anymore; it’s about looking out for their own backyard and ultimately their own personal gain. And those tariffs and taxes? They get passed down to the manufacturers, and ultimately to us, the consumers.

Take the U.S., for example. We import, as I mentioned before, roughly 90% of the aluminum we use, mostly from Canada. So, when Canada or Mexico slaps tariffs on aluminum exports, that’s a direct hit to U.S. manufacturers. And on top of that, CBAM is making it more expensive to export aluminum to Europe. All of these taxes and tariffs are raising costs across the board, whether it’s for carmakers or companies making products with aluminum. That just means higher prices all around.

The way forward: Work together or thorough long term game plan

A possible solution would be for the U.S., Canada, Mexico and Europe to start working together again instead of building more barriers. Perhaps it might be time to revisit trade agreements like USMCA and look at ways to reduce tariffs and taxes between these countries, while figuring out how to deal with environmental concerns like carbon standards.

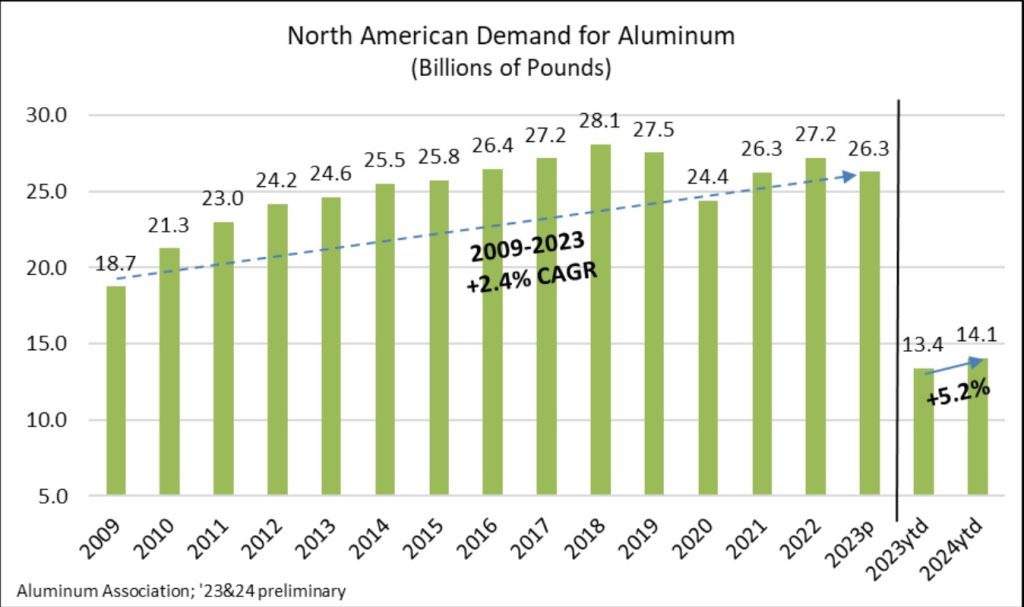

Don’t get me wrong, it’s the American dream to produce all the metal, including aluminum, that we need right here in the U.S. But has anyone really run the numbers and a game plan on how to get there? At our current state we are already seeing higher prices all around, the economy is still not healthy (as we haven’t had the chance to fully recover from COVID times), and we are nowhere near the ability to supply our own aluminum, even though demand has decreased immensely since 2022 (as seen in the chart below by The Aluminum Association) and even if we also turn to recycled metals. Recycled metals are already hurting in terms of pricing and supply gluts.

Right now, every country seems focused on protecting its own industries, and it’s creating more problems than solutions. If we don’t start cooperating again, aluminum trade will stay expensive and complicated, which hurts everyone. We need to find a way to get past these short-term fixes and work toward something that benefits all countries involved. Otherwise, we’re just going to keep spinning our wheels and paying more in the process.

In the end, what was once a smooth and cooperative trading system has turned into a battlefield of tariffs, taxes, and carbon policies like CBAM. Don’t get me wrong, CBAM is a great start. Where Europe excels in its slow but steady planning, the U.S. excels implementing and standing firm with its import tariffs. For example, if the U.S., Europe and even Canada shared their expertise in these fields, growing and working on one other’s strengths, think of how this would help these countries in the long-term view rather than the current short term, individual self-gain.