Market

October 8, 2024

RMU survey results: The industry remains in a state of uncertainty

Written by Gabriella Vagnini

The Recycled Metals Update (RMU) survey results for the month of September paint an interesting picture of the current dynamics in the industry. Participants across various parts of the recycled metals industry, including manufacturers, processors, and traders, shared their insights on supply, demand, and pricing, highlighting several key trends and obstacles.

Most market participants report stable demand for their products. However, some manufacturers see demand higher than supply, indicating some tightness in the market. One respondent commented that “post-consumer recycling rates appear to be dropping,” pointing to a potential concern in recycled metals.

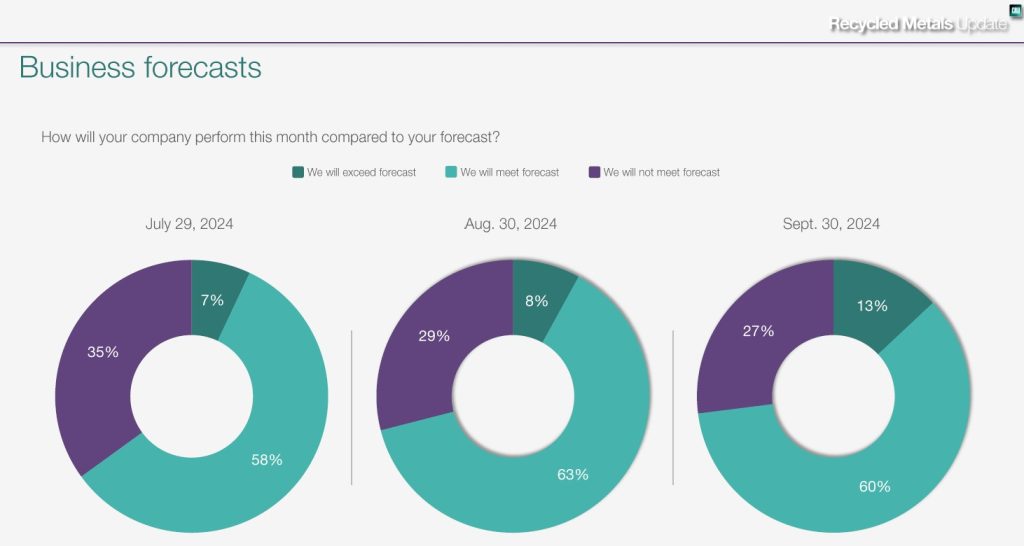

While 60% of respondents think they’ll meet their forecast for September, that’s down from 63% in August. The number of companies expected to exceed their forecasts has gone up slightly to 13%, compared to 8% in August and 7% in July. However, the percentage of companies that expect to miss their forecasts is still significant, though it’s improved from 35% in July to 27% in September. What could this outlook be pointing towards? Stabilizing conditions or a cautious optimism as companies adapt to market challenges.

A recurring obstacle mentioned by several participants is the impact of logistical challenges. For example, a processor/recycler noted a “lack of booking and equipment at ports” as a major barrier to efficient recycled metal flow. Similarly, other processors pointed to the slow movement of recycled metals at ports as a problem that could disrupt the flow and shipment of materials.

Another key theme is uncertainty in pricing and supply due to global factors. One scrap dealer/recycler expressed concerns about how politics and economic conditions are affecting business, commenting that “everyone is scared of the election. One side will help, the other will tax us to death.” This highlights the industry’s sensitivity to policy changes, especially as we approach a major election year.

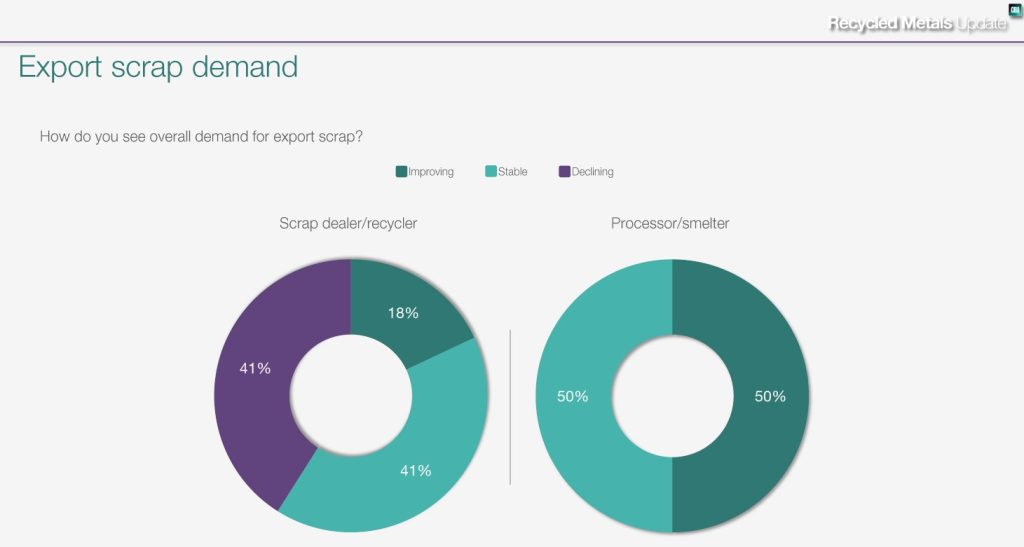

On the export side, responses were mixed. Some processors see export demand tightening, while others, such as scrap dealers, predict a weakening of U.S. export prices due to competition from Europe and elsewhere. A respondent from the scrap recycling sector captured this sentiment, saying, “If there is stronger export demand, it will tighten supply domestically.”

As for scrap pricing, there are varied predictions for both ferrous and non-ferrous materials. One manufacturer expects busheling prices to hit “$500 per gross ton or higher,” while others foresee prices remaining more stable, citing steady or declining demand. A few processors, however, predict that ferrous scrap prices might actually increase due to demand picking up ahead of the holiday season, with one respondent mentioning that mills are “looking to secure additional volumes.” Final survey results for busheling price predictions for October showed that 38% of respondents believe it will be at $400-$449 per gt, while 32% believe it will be around $350-$399 per gt. As of Monday, Oct. 7, we still have yet to see where October busheling prices will land. RMU will keep our readers updated once the prices are released.

Overall, the survey reflects a market still grappling with uneven demand and supply across different regions and sectors, alongside ongoing logistical challenges, and external pressures from political and global market forces.

With the U.S. presidential election quickly approaching and the plethora of metals conferences from September behind us, it will be interesting to see what market participants will have to say in the October survey.