Market

June 4, 2024

Prices divide traders and manufacturers in RMU survey

Written by Gabriella Vagnini

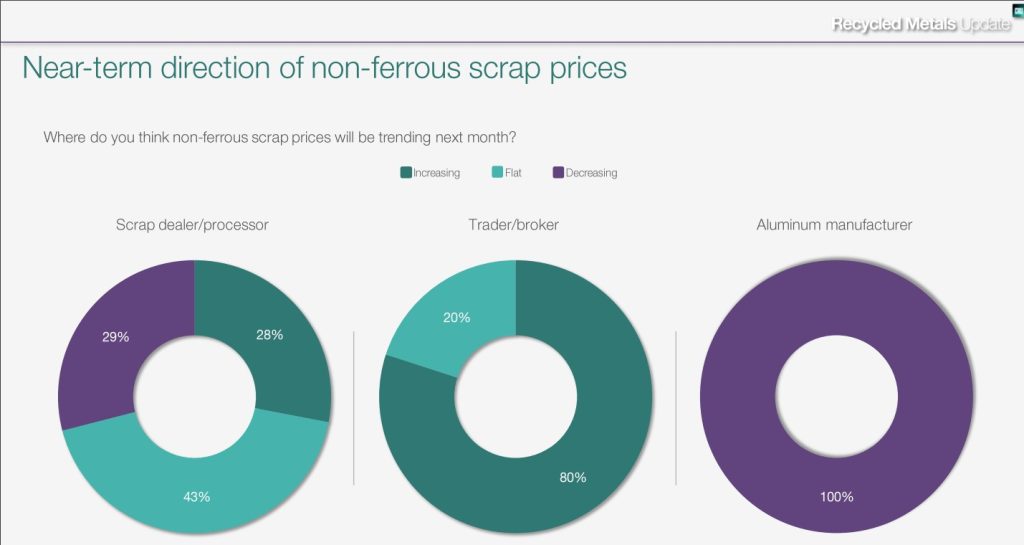

Despite a bullish sentiment in the market, Recycled Metals Update’s latest survey reveals a surprising divergence in non-ferrous scrap price expectations for next month.

A staggering 80% of traders are betting on price increases, driven by strong investor interest and tight market conditions in the U.S. However, in a shocking contrast, 100% of aluminum manufacturers predict a price decrease, reflecting significant inventory build-ups and potential de-stocking cycles in China. This unexpected split is sure to stir up intense interest and speculation in the market.

Those numbers come from the most recent monthly Sentiment Survey conducted by RMU. Scrap professionals across the country participate, with results reflecting the most current views of the market sentiment. The survey provides a history of market data as well as tracking features to see how conditions shift.

Overall, metals are down across the board, adding to the market tension.

Copper has notably dropped below the $10,000 mark, retracting about a third of its gains from the past month. Several factors contribute to this selloff, including fund liquidation and mixed macroeconomic data from China and the U.S.

The ISM manufacturing index for May fell to 48.7, below expectations, while April construction spending decreased by 0.1%. Oil prices have also dropped significantly following OPEC’s decision to extend production cuts until 2025, highlighting concerns about global growth. Precious metals are selling off, and U.S. equities are expected to open weaker. India’s Sensex fell by 5.7%, erasing much of Monday’s gains amid election-related concerns. All these are added contributors to the price flux.

RMU’s survey also revealed that 88% believe improvements in export prices will not affect domestic prices, contrary to current market trends.

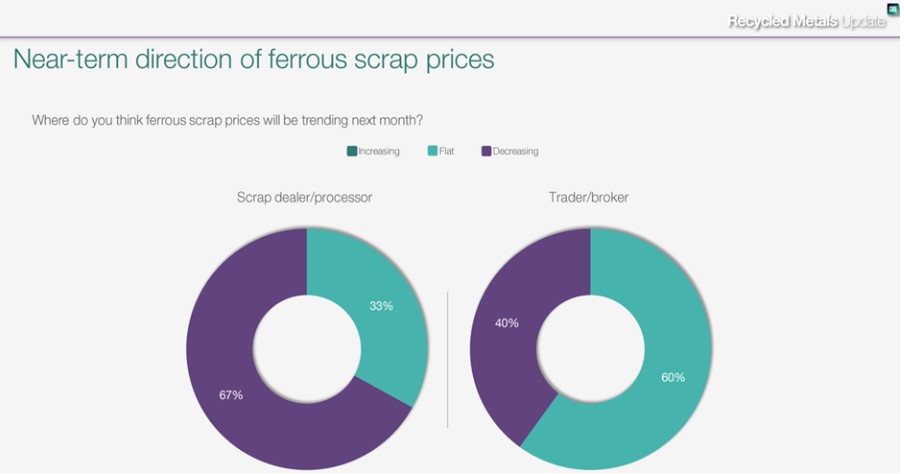

Most respondents noted flat or declining obsolete scrap flows and falling demand for scrap, predicting future price drops, with consensus pointing to a decline in ferrous scrap prices in June due to steel mill outages and slower sales.

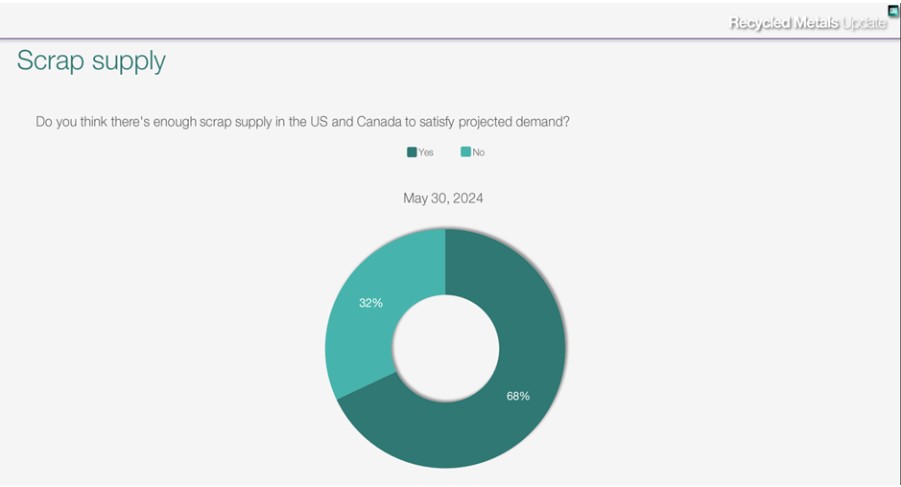

Interestingly, while current scrap supply seems adequate, there are concerns about future shortages, and only 14% of respondents think mills are pricing fairly, highlighting potential strategic gaps in the industry.

Additionally, a recent report indicated that global steel production is expected to dip by 5% this year, which could further impact scrap demand and pricing.

While 80% of traders foresee rising non-ferrous scrap prices, a full 100% of aluminum manufacturers predict a decline, indicating a potential market shake-up driven by contrasting supply and demand dynamics.

It is a foregone conclusion that ferrous scrap price will decline in June as no respondents feel prices will rise. Other sources have pointed out there will be a lack of demand due to steel mill outages and slower steel sales.

Many respondents feel there is enough scrap for the time being, but for the next several years, some comments show the supply of scrap in North America may not be adequate.

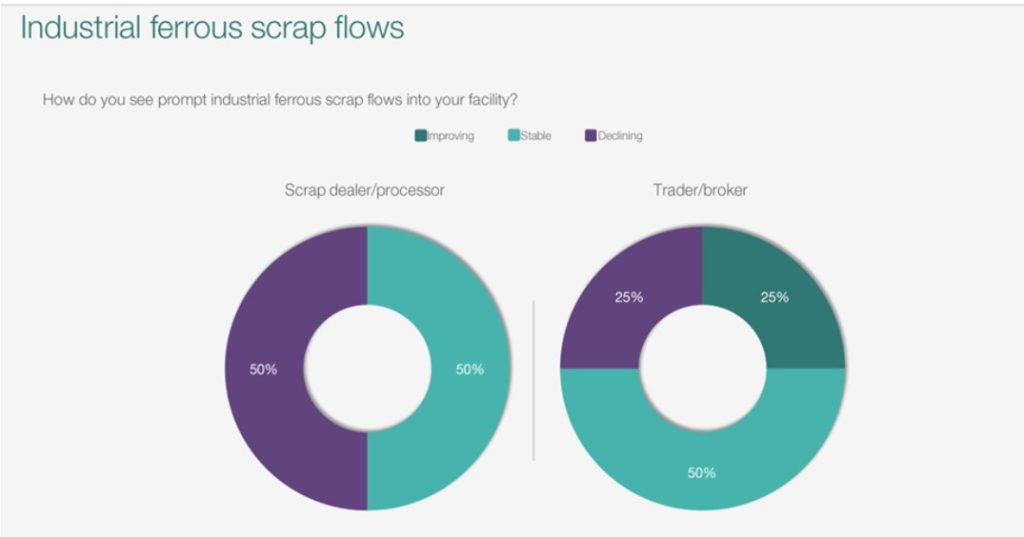

Since 50% of dealer/processors indicate industrial scrap flows are declining and 100% saying the flows are declining or flat, this may indicate a slowing in the manufacturing sector. This is not unusual in the summer months.

Share your thoughts

Recycled Metals Update is a team of industry experts from across the recycled metals supply chain providing you with broad insights and unique perspectives on news and analysis. Participating in our monthly survey amplifies your perspective and helps shape the results.

Survey participants are granted first access to the results, which are summarized each month in our newsletter. Want to add your voice to this discussion? You can opt-in here.