Market

April 30, 2024

RMU Survey: Prices for ferrous, non-ferrous unlikely to fall soon

Written by Stephanie Ritenbaugh

Prices for ferrous and non-ferrous scrap are not likely to drop in the short-term, according to Recycled Metals Update’s latest survey results.

RMU’s monthly survey polls over 200 companies — dealers and processors, traders, mills and other segments of the market — to track sentiment, pricing and scrap flows and other trends.

On the ferrous side, about two-thirds of the respondents indicated ferrous scrap prices would remain stable, while one-quarter thought they would rise in May. Only 7% said prices would drop over the next month (see Chart 3).

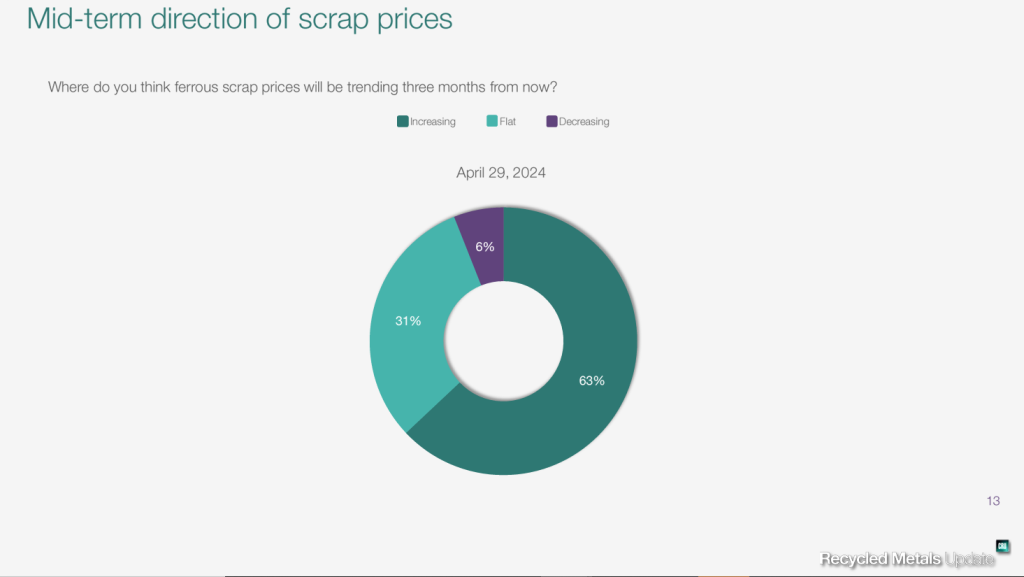

Over the next three months, 63% of survey respondents thought ferrous prices would increase, 31% said they would be stable, while only 6% indicated prices would decrease.

One respondent noted that while many suppliers hope prices will go up, “demand is average” and scrap is available.

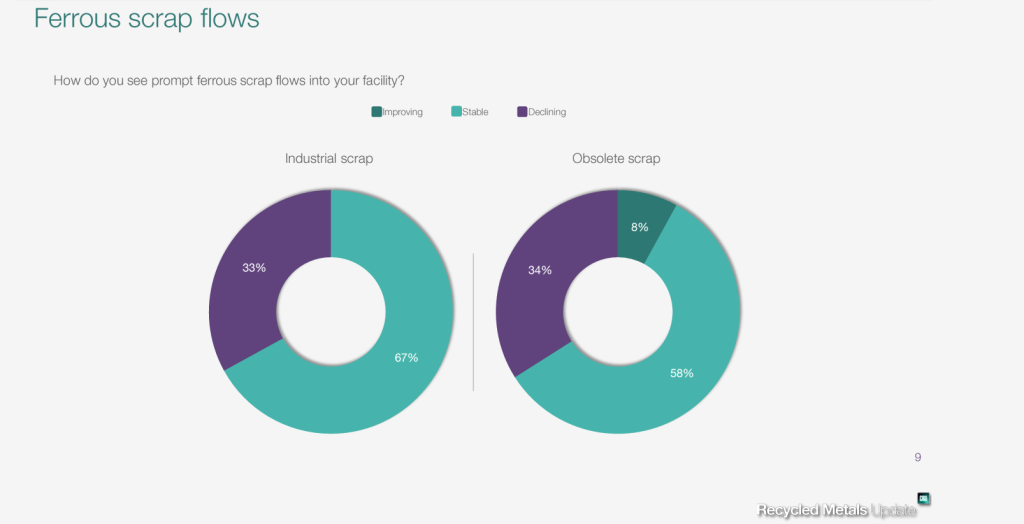

Meanwhile, participants reported that flows for ferrous scrap into yards were largely stable, with 67% saying industrial and 58% saying obsolete scrap were holding steady.

As for non-ferrous, in the near-term, there is a strong indication of a significant increase in scrap prices, attributed to multiple factors.

The survey findings corroborate this assessment, highlighting the prevailing imbalance between supply and demand as a key driver of upward price pressure.

Mills are increasingly likely to encounter a scarcity of scrap materials, placing them in a vulnerable position vis-à-vis sellers and feeding into a bullish market sentiment. This trend is said to be already evident, particularly with UBCs, where reports suggest sales have surged by over 73%.

About half of survey participants see non-ferrous scrap prices increasing, while about 36% expect them to stay flat over the next month.

One respondent commented, “With the LME spike, prices have increased a bit but spreads have moved very little.”