Market

March 5, 2024

Aluminum heads into March with questions

Written by Gabriella Vagnini

A rally in aluminum pricing in January proved to be short-lived, as the premium fell by 1.55 points in early February. This resulted in a sharp decline and leveling off in the latter half of the month, allowing the Midwest US Transaction Premium (MWUSTP) to close the month at 1.14/lb. Having navigated through the challenges of the year’s outset, March is beginning with a promising uptick with MWUSTP at 1.16/lb.

Since the MWUSTP is the base price that the aluminum scrap spreads use to determine the scrap item for pricing, let’s delve into the concerns that shaped the previous months and assess our prospects as we over forward into March.

February typically signifies a subdued period for metals, and non-ferrous scrap is no exception. The onset of the Chinese New Year usually corresponds to reduced participation from China in the market and is reflected in the base prices, resulting in a stagnant market. However, concerns arise elsewhere. Scrap yards are indicating insufficient inflows, leaving the buyers of aluminum scrap in a panic. Adding to the complexity, some yards are said to be stockpiling their current inventory, anticipating better returns in the future.

While the sale of aluminum scrap is declining, there is a notable surge in demand from consumers. With scrap yards withholding their supplies, buyers, particularly extruders, are increasingly turning to RSI (remelt secondary ingots). This heightened interest in the RSI market is causing a scarcity in stored RSI as well.

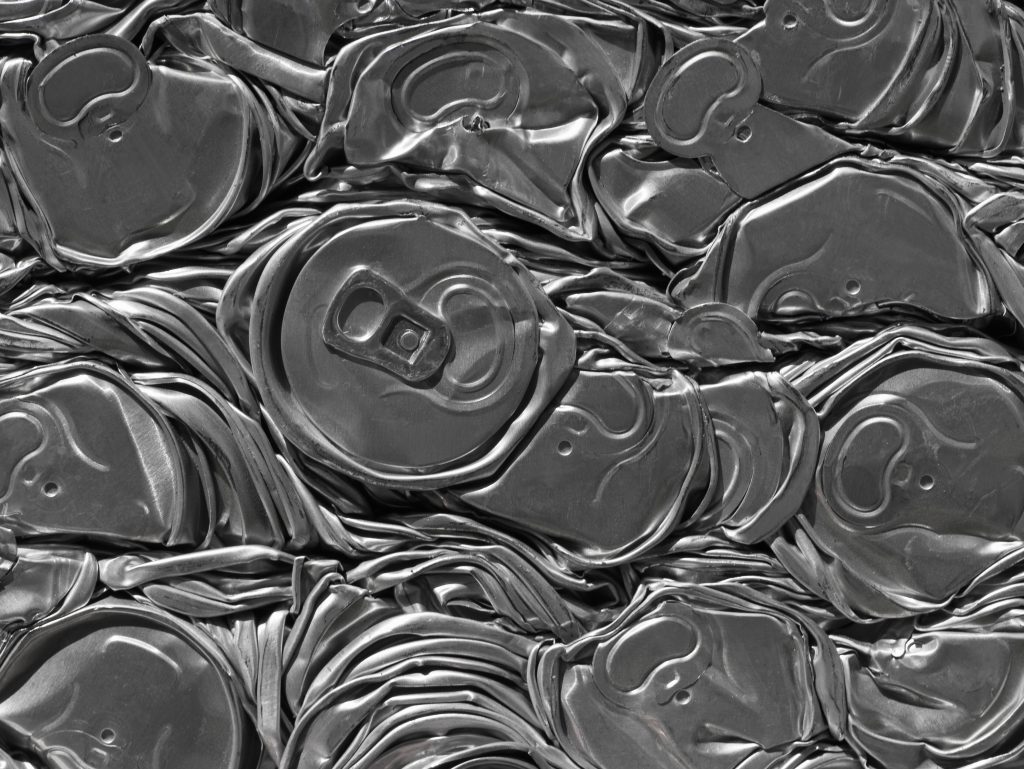

As base prices remained flat in February, the spreads had little to no change. However, March did see a bit of an increase in UBC. The used beverage cans (UBC) remained steady at about 66% throughout February but saw a solid move to 69%, starting March on good note for sellers. Painted aluminum siding (PAS) remained unchanged in February at roughly 68% and no change going into February. The same for mixed low copper (MLC) as it also exhibited a consistent spread, holding at roughly 73%.

Market chatter suggests that the situation may not improve in the near future. Typically, April and May would witness increased inventory inflows and price rallies, but many anticipate that such improvements will not materialize in Q2.