Market

September 10, 2024

Week in review: Tough road through September

Written by Stephanie Ritenbaugh

September kicked off with Great Lakes-area steel mills entering the ferrous scrap market. Mills in Detroit have reportedly bought scrap sideways from August, with the exception of shredded scrap, which fell $20/gt.

In conversation with a major scrap seller in the Midwest, it was mentioned that Chicago has not officially bought yet. RMU’s Stephen Miller noted, given that mills in the area are expected to buy scrap at nearly normal levels, the prices paid by Detroit may not be well received in Chicago.

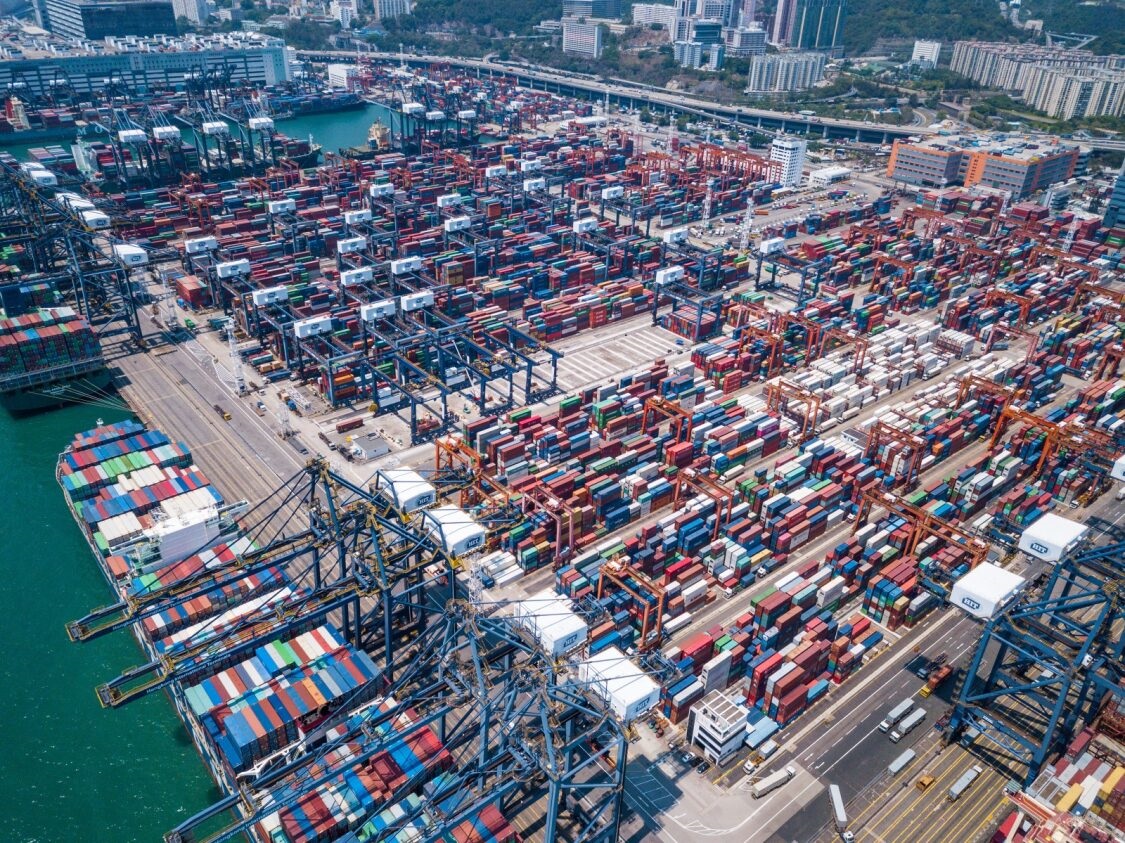

On the export side, the billet invasion into Turkey is underway. Prices have stabilized as Chinese mills have attempted to raise prices, but not to any significant extent. Another thing we are hearing is that Turkey may be canceling or renegotiating orders from China that are late and higher priced. The pig iron market in Brazil has also experienced a drop in prices to the U.S. In general prices dropped more modestly than U.S. buyers had hoped.

RMU’s Gabriella Vagnini noted the recycled metals market is still facing a tough road through this month, and possibly the rest of the calendar year. The steel market’s underperformance has had a ripple effect, dragging down ferrous scrap prices with it. In fact, this may be the time to look into hedging to minimize risk over the next several months.

U.S. manufacturing activity contracted for a fifth straight month in August, according to the latest from the Institute for Supply Management (ISM). The Index has indicated contraction in the manufacturing sector for 21 of the last 22 months. Despite this, ISM said the overall economy remained in expansion for the 51st month in a row through July.

There’s been another wrinkle in closely watched pending tie-up between Japan’s Nippon Steel and Pittsburgh’s U.S. Steel. President Joe Biden could block the nearly $15-billion sale of U.S. Steel to Nippon by citing national security concerns. That news hit just hours after U.S. Steel President and CEO David Burritt said in a statement that the Pittsburgh-based steelmaker might close plants, cut thousands of jobs, and move its headquarters if the deal did not go through. Our sister publication, Steel Market Update, has that story.

Economic highlights

Economic activity continues to struggle in most districts, according the Federal Reserve’s Beige Book. The report for August shows two-thirds of reporting districts flat or declining economic activity. The Beige Book is a summary report of commentary on current economic conditions across the Federal Reserve’s 12 districts.

Some key points for the scrap market: Auto sales continued to vary by district, with some noting increases in sales and others reporting slowing sales because of elevated interest rates and high vehicle prices. Manufacturing activity declined in most districts, and two districts noted that these declines were part of ongoing contractions in the sector. Residential construction and real estate activity were mixed, though most districts’ reports indicated softer home sales. Likewise, reports on commercial construction and real estate activity were mixed.

District contacts generally expected economic activity to remain stable or to improve somewhat in the coming months, though contacts in three Districts anticipated slight declines.

On Friday, the Labor Department said hiring picked up a bit in August. Total nonfarm payroll employment increased by 142,000 in August, up from 89,000 in July. The unemployment rate inched down to 4.2%. Job gains occurred in construction and health care.

“The cooling jobs figures underscore why the Federal Reserve is set to cut its key interest rate when it next meets Sept. 17-18, with inflation falling steadily back to its target of 2%,” the Associated Press noted.

Economic calendar highlights this week:

| Wholesale trade | Monday, Sept. 9 | 10 a.m. Eastern |

| Survey of consumer expectations | Monday, Sept. 9 | 11 a.m. Eastern |

| Consumer price index | Wednesday, Sept. 11 | 8:30 a.m. Eastern |

| Initial claims | Thursday, Sept. 12 | 8:30 a.m. Eastern |

| Producer price index | Thursday, Sept. 12 | 8:30 a.m. Eastern |

| Weekly economic index | Thursday, Sept. 12 | 11:30 a.m. Eastern |

| Imports and exports | Friday, Sept. 13 | 8:30 a.m. Eastern |