Scrap Processors

September 16, 2024

Week in Review: Steady prices, construction surge and global uncertainty

Written by Gabriella Vagnini

Market news and updates

- LME prices hold steady: The U.S. dollar eased up a bit after the jobs report, giving the LME aluminum 3 month price a bit of a lift. But overall, the market is still cautious, with uncertainty lingering around the recovery of economic activity, particularly in construction and manufacturing.

- Non-residential construction boom: Rising non-residential construction would point to more scrap metal demand, as well as potential for more next year.

- Balance of scrap market: RMU’s August’s survey showed a shift, with 57% now believing the scrap market is in balance, compared to 55% in July who thought otherwise.

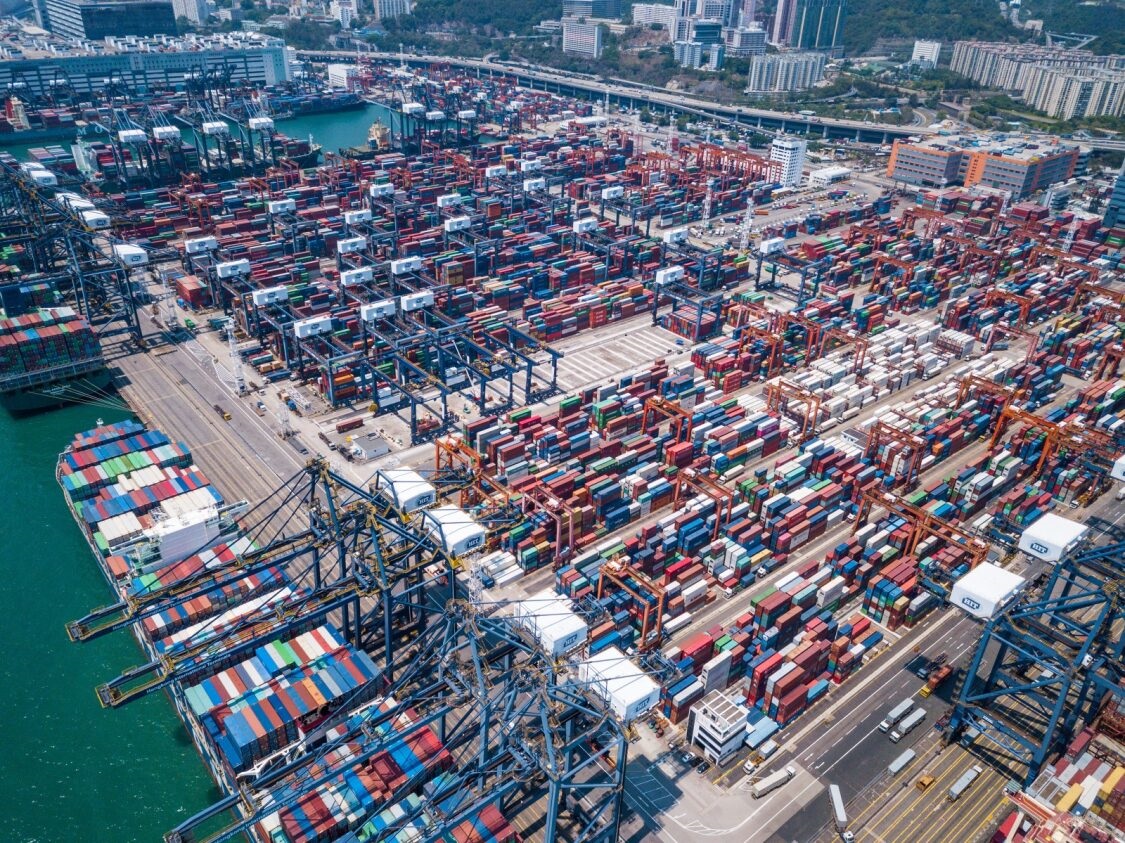

- Copper export prices: Export prices for copper remained higher than domestic but falling demand from China is putting downward pressure on those export prices. This shift will play a ripple effect and eventually affect domestic scrap pricing.

- U.S. East Coast ferrous scrap exports: There’s been a small uptick in pricing in ferrous scrap exports, with HMS reaching $370/mt and shredded scrap hitting $390/mt. Export demand challenges also show weakness in China’s steel market and increased competition in rebar continue to pressure export demand, keeping prices flat for U.S. and European cargoes booked by Turkey.

- U.S. steel production: Weekly raw steel output fell by 2% year-to-date, signaling weaker demand. This could drive down scrap steel prices, with HMS prices possibly dropping to $285/gt.

- Inflation and trade deficit: A widening U.S. trade deficit and modest inflation increases might raise operating costs for scrap recyclers and hinder export opportunities.

M&A’s, Expansion plans, and EV updates

- Tri-Arrows and Tennessee Aluminum Processing (TAP) joint venture: Construction has begun on a $40 million aluminum recycling facility in Kentucky. This plant will process dross and scrap into molten aluminum.

- New hydro recycling plant: Hydro is also building a new 90,000 mt capacity aluminum recycling plant in Hungary, focusing on the automotive market with post-consumer scrap.

- Alcomet expansion in Bulgaria: Alcomet is expanding its product range with a $77 million investment to target the EV battery and automotive sectors.

- Stellantis layoffs: Stellantis is shutting down its production of the Ram 1500 at its Warren, Michigan plant, laying off over 2,400 workers after a significant 48% year-over-year drop in profits for the first half of 2024.

- EV production at Stellantis Warren plant: However, Stellantis is also gearing up for a $97.6 million investment in electrified Jeep Wagoneer production at the same plant, set to begin by the end of 2025.

- U.S. Steel acquisition by Nippon, stalemate: In an article released on Friday, SMU noted that the White House may delay its decision on blocking Nippon Steel’s bid for U.S. Steel until after the presidential election. One would think that the bigger concern is not so much the delay, but that both presidential nominees had said that they will both block the deal if they become president.

Economic highlights

- Last week: Economic reports suggest mixed implications for the scrap metal industry. While the labor market remains strong, supporting stable economic activity, rising inflation (CPI and PPI) and cautious wholesale restocking signal potential headwinds for manufacturing sectors that drive scrap metal demand. Meanwhile, consumer expectations for inflation are stable, which may bolster demand in automotive and construction, but weaker global demand, reflected in softer exports, could increase domestic scrap availability and put downward pressure on prices. Overall, inflationary pressures and global uncertainty feed the continued cautious outlook for scrap metal demand in the near term.

- Steel industry calls for trade reform: AISI and steel industry groups urged the U.S. Senate to pass the Leveling the Playing Field 2.0 Act to combat unfair trade practices, highlighted China’s non-compliance with WTO commitments, and supported updates to U.S. trade laws to better enforce antidumping and countervailing duty measures.

- Fed talk: The big talk last week was hyper focused on the anticipation of this week’s Fed interest rate cut. On Friday, Former New York Fed president Bill Dudley said on Bloomberg “I think there’s a strong case for 50.” This, of course, is referring to how much the interest rates will be cut. He also went on to say, “I know what I’d be pushing for.”

Economic calendar highlights this week:

| U.S. retail sales | Tues., Sept 17th | 8:30am EST |

| Industrial production | Tues., Sept 17th | 9:15am EST |

| Housing starts | Wed., Sept 18th | 8:30am EST |

| FOMC Interest-rate decision | Wed., Sept 18th | 2:00pm EST |

| Fed Chair Powell press conference | Wed., Sept 18th | 2:30pm EST |

| Initial jobless claims & Philadelphia Fed manufacturing survey | Thurs., Sept 19th | 8:30am EST |