Market

May 3, 2021

Final Thoughts

Written by Michael Cowden

I wish I could start off writing about something other than steel prices. That said, since I joined SMU from Fastmarkets AMM in early January, the news really has been the price.

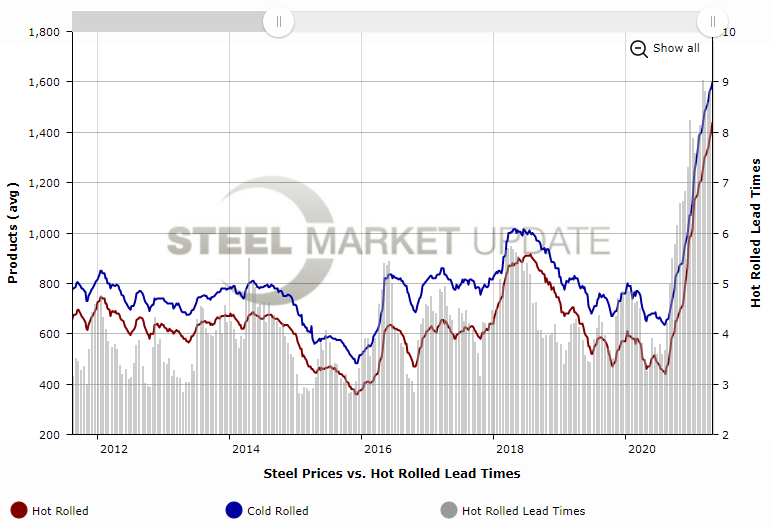

SMU’s average hot-rolled price on Tuesday, May 4, stood at $1,500 per ton ($75 per cwt). That’s a 12.8% increase from $1,330 per ton a month ago and a staggering 52.3% increase from $985 per ton at the beginning of the year.

We’re now well above the prior peak of $1,070 per ton in July of 2008–just before the last financial crisis, according to SMU pricing archives. And that’s true even if you adjust for inflation.

I sometimes do a double take when looking at the latest numbers because I’m not sure whether it’s a hot-rolled price or a cold-rolled price. I’m used to them staying in certain bandwidth. Now, prices move up so fast it often seems that this week’s cold-rolled price is next week’s hot-rolled price.

And that’s not just my impression. It’s in the data, as this chart from SMU’s interactive pricing tool shows:

Unprecedented

I know we’re all tired of hearing the word “unprecedented,” but these are truly unprecedented times.

And this is not only happening in steel. We’re seeing record prices and shortages across the board. I saw a post on my LinkedIn feed recently joking that a cargo of lumber had been smuggled in a shipment of cocaine.

And I know some of you might be laughing at the notion of an fob mill price. Because you can’t get tons at any price. Or you’re paying resale prices that border on extortion.

For others, you’re looking sharp because you’re covered by contracts based on a percentage discount to CRU. CRU minus 7.5% would be minus $112.50 per ton. And so those contracts might be looking pretty good right now versus ones based on a specified dollar discount.

I note that to illustrate that when those contracts were being negotiated last fall, not even the mills knew what was coming. Because some of them were the ones pushing hardest for percentage-based discounts.

Whatever your situation, it’s understandable that prices around $1,500 per ton are a scary thing.

While some people think the market has nowhere to go but up, others fear this just can’t last much longer. Will imports or new capacity send things the other way? Will high prices lead to demand destruction? Or is the bigger risk remaining on the sidelines and missing out on continued strong demand?

I hate comparisons now to 2008. But they are apt in certain respects.

Hot-rolled coil prices started out 2008 at about $605 per ton. They were over $1,000 per ton by early May. So you could have bought a hot band in early 2008, held it, and then sold it for scrap at a profit in a matter of just a few months.

The same could be said of the current market. Hot-rolled coil hit a 2020 low of $440 per ton last August. Prime scrap is now more than $100 per ton above that figure.

But steel is a cyclical industry. The peaks and valleys don’t typically last for very long. And things fell apart quickly in 2008. HRC ended the year at $530 per ton–or slightly less than half what it had been just six months earlier.

The parallels between now and then are eerily similar in some senses. Why might this time be different? (And I realize that merely asking that question has in the past been a bad omen.)

For starters, I don’t think we should knee-jerk assume that prices are going to cycle down hard again like they did in 2008. Because a financial crisis and a post-pandemic economy are two very different things

Also, Consolidation

Yes, Cleveland-Cliffs is running all eight of its active blast furnaces now. And U.S. Steel–the only other integrated steelmaker in the U.S. now–is running most of its furnaces as well. Details are on SMU’s blast furnace status tool.

But things aren’t as they were before Cliffs’ acquisitions of AK Steel and ArcelorMittal USA. Cliffs has made no secret that it intends to drive a harder bargain with automakers than AK and AMUSA had. And Cliffs’ CEO Lourenco Goncalves thinks consolidation has left his company in a much stronger position to do so. In short, buyers ignore the impact of consolidation at their own peril.

A lot has also been made of all the new flat-rolled EAF capacity that’s coming online. And how that’s going to collide with existing integrated capacity and potentially send the steel market into a tailspin. So far, that hasn’t happened. And, given how much integrated capacity has been permanently idled, there is a case to be made that it might not happen.

Cliffs pointedly said on its earnings call that the Amanda blast furnace at its Ashland Works and the No. 3 furnace at its Indiana Harbor Works would not be restarted–not even to make pig iron. And the company also said it wouldn’t sell them. So that capacity is done. It’s off the grid.

And U.S. Steel on its earnings call made clear that it has no intention of restarting the hot end at Great Lakes Works or the second furnace at Granite City unless market conditons were to change dramatically.

So, yes, integrated capacity has been restarted since the early days of the pandemic. But there is a lot less of it now.

I might keep a closer eye on more immediate concerns, like the chip shortage, which is a big problem for automakers in North America and around the world. And it’s not just automakers that are dealing with it. So are other steel-intensive industries like appliance.

In the meantime, though, there are no indications of things slowing down, at least in the short term.

Lead Times

It’s not just prices that keep setting new records. So, too, do lead times.

Hot-rolled coil lead times are nearly 10 weeks, double what they were in September and triple what they were a year ago.

Things are even more extended on the cold rolled side–an average of 12 weeks. So any steel ordered now won’t arrive until late July or early August.

And keep in mind SMU publishes averages. I’ve heard of instances where lead times are out 20 weeks or more on the coated side.

In short, if you’re ordering steel now, you have to have a pretty good idea of what’s going to happen not just in the second half of the year–but in the fourth quarter and going into 2022 as well.

So it might sound crazy to say it this early in the year. But it’s time to start having 2022 contract talks.

As you prepare for those, you also have to ask yourself this: Is a year-long trend of higher prices possible?

The answer to that question in ordinary times would be “no.” But these are not ordinary times.

I remember being told prices would start to unwind after Thanksgiving. Guess what? HRC prices were at $805 in early December–a very high price by historical norms. Then I was told you’d start to see cracks after Christmas? Guess what? It wasn’t long into 2021 before prices were over $1,000 per ton. Then, just last month, most respondents to one of our surveys said prices would peak at or below $1,400 per ton. And here we are, just a few weeks later, at $1,500 per ton.

I said during one of our Community Chat webinars back in January that a lot of Chicken Littles have been proven wrong. And they’ve been wrong for more than nine months now. But if you say the sky is falling often enough, you’ll be right, eventually.

By Michael Cowden, Senior Editor, Michael@SteelMarketUpdate.com

P.S.: If you want to learn more about what record high prices mean for the steel industry, you should attend CRU’s Annual New York Steel Seminar. It’s on June 16. It’s virtual this year and free to any and all to attend. To register, click here.

Also, SMU’s Steel Summit will be live at the Georgia International Convention Center in Atlanta in August. For more details, click here.

And, finally, a public service announcement: Please get vaccinated. We all want to catch up in person after a year of being remote. And if you get your shot–or, better still, shots–it will be a lot easier for us to do that.

The post Final Thoughts appeared first on Steel Market Update.