Prices

July 28, 2023

Earnings decline at Nucor and Cleveland-Cliffs

Second-quarter net income decreased year-on-year for US steel producers Nucor and Cleveland-Cliffs as prices and turnover fell. Nucor is bracing for lower profits; Cleveland-Cliffs is looking forward to higher shipments.

North Carolina-based Nucor said it expects company earnings in Q3 will be less than the $1.46 bn (€1.32 bn) achieved in Q2 because of decreased profitability in the steel mills’ segment, an easing back on operating income from steel products, and lower earnings from the raw materials segment due to margin compression at both the direct reduced iron (DRI) plants and scrap processing operations.

The second quarter’s bottom line of $1.46 bn was 42.3% lower than in the year-ago period, with sales revenue 19.3% less at $9.52 bn and total shipments 5.6% less at 6.59 M s.tons.

Those downers were partially offset by total costs falling a tenth to $7.47 bn, helped by the average scrap and scrap substitute cost declining 14.8% to $455 /s.ton (gross) from a year-ago $534 /s.ton (gross).

Net income at Ohio-based Cleveland-Cliffs sagged 41.8% year-on-year to $347 M in Q2, with turnover down 5.7% to $5.98 bn and the average selling price by 15.6% to $1,255 /s.ton from $1,487 /s.ton.

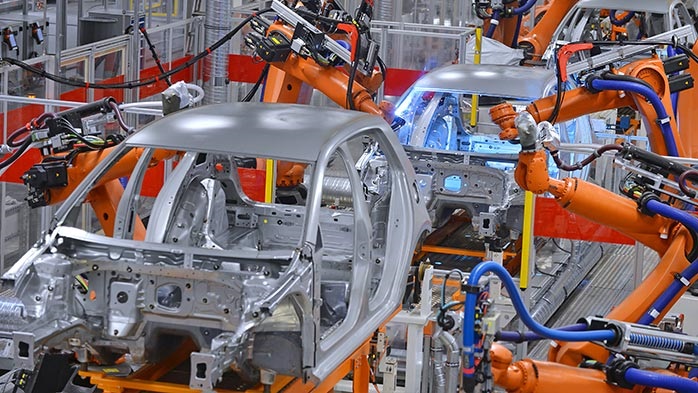

But shipments increased 15.8% to 4.20 M s.tons, which company chief Lourenco Goncalves attributed to another record in automotive sector deliveries. “This shift to a higher automotive mix led to even higher realised prices than we were expecting,” he added.

Referencing the company’s transformation in 2020 from just being an iron ore producer, he said: “Looking forward, we are on pace for our best shipment year since becoming a steel company. Service centre inventories are significantly lower than historical levels, creating support for a healthy second half of the year…

“While the performance of our automotive clients continues to improve, the sector has not returned to pre-Covid levels yet, indicating that Cleveland-Cliffs still has plenty of value to be unlocked in the near future.”