Non-ferrous scrap spreads remain unchanged

While the rest of the industry grapples with turmoil and plummeting prices, non-ferrous scrap spreads appear to remain unaffected, at least for the time being.

While the rest of the industry grapples with turmoil and plummeting prices, non-ferrous scrap spreads appear to remain unaffected, at least for the time being.

With more EV companies opening in Mexico, what could this mean for the US? And what could this do to our relationship with our largest trading partner?

In a surprising turn, a Rocky Mountain mill resumed its purchasing program at half its normal capacity, signaling potential stabilization in the Texas/Gulf region for the upcoming month.

The drop in its offer prices was larger than most industry observers had forecast, especially for shredded scrap.

Monthly SRU survey finds near-term ferrous prices could fall

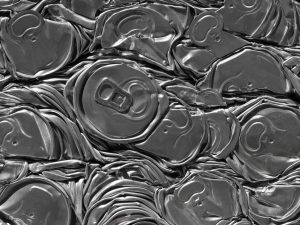

Here's a look at price spreads for aluminum scrap and copper scrap from the start of March. Copper scrap spreads remained flat, while aluminum scrap exhibited some widening.

Even though it’s the fifth of the month, there have been no confirmed purchases by domestic steelmakers. Rumors are circulating about how low prices will drop. Most of the scrap community is forecasting a $50/gt drop for #1 busheling, with shredded and P&S at perhaps $40/gt.

Non-ferrous scrap spreads remained tight amid ongoing global shipping constraints, raising concerns.

While the sale of aluminum scrap is declining, there's a surge in demand from consumers.

Aluminum Roundup: IAI reports aluminum industry greenhouse gas emissions declined in 2022